Commoditization of 5G Spreads to High Data Plans in Some European Markets

by Will Watts

As mobile carriers fight to differentiate their services and maintain prices, a key target area has always been high data volume 5G plans. Most mobile operators have long projected that this premium segment would be the least sensitive to downward pricing pressure, given that these customers tend to be wealthier and, due to their heavy phone usage, would be more aware of the differences between providers and mobile service tiers. In short, if operators could charge a premium to any customer group, these would be the ones.

While it is still early in the process, there is mounting evidence that even this strategy may not overcome the general trend towards commoditization facing the mobile industry. Currently, in its studies of 5G pricing, Tarifica categorizes the top segment of mobile consumers – the “super users” – as 100GB a month of mobile data (though there are some even heavier users, these represent a minuscule portion of the market). In just the last quarter, operators in Belgium, Ireland, Spain, and, particularly, Poland all significantly reduced prices for this group. If these pricing trends persist and are replicated in other countries, these “super users” will become just another market segment where operators face declining margins over time.

An Instructive Example: 20GB Plans in Germany

Looking back, it was not too long ago that 20GB per month of high-speed data was considered heavy usage, with consumers in this segment being viewed as the key to future growth for operators. However, across multiple markets, prices for this segment have fallen substantially as operators have felt pressure to offer ever more data for similar prices.

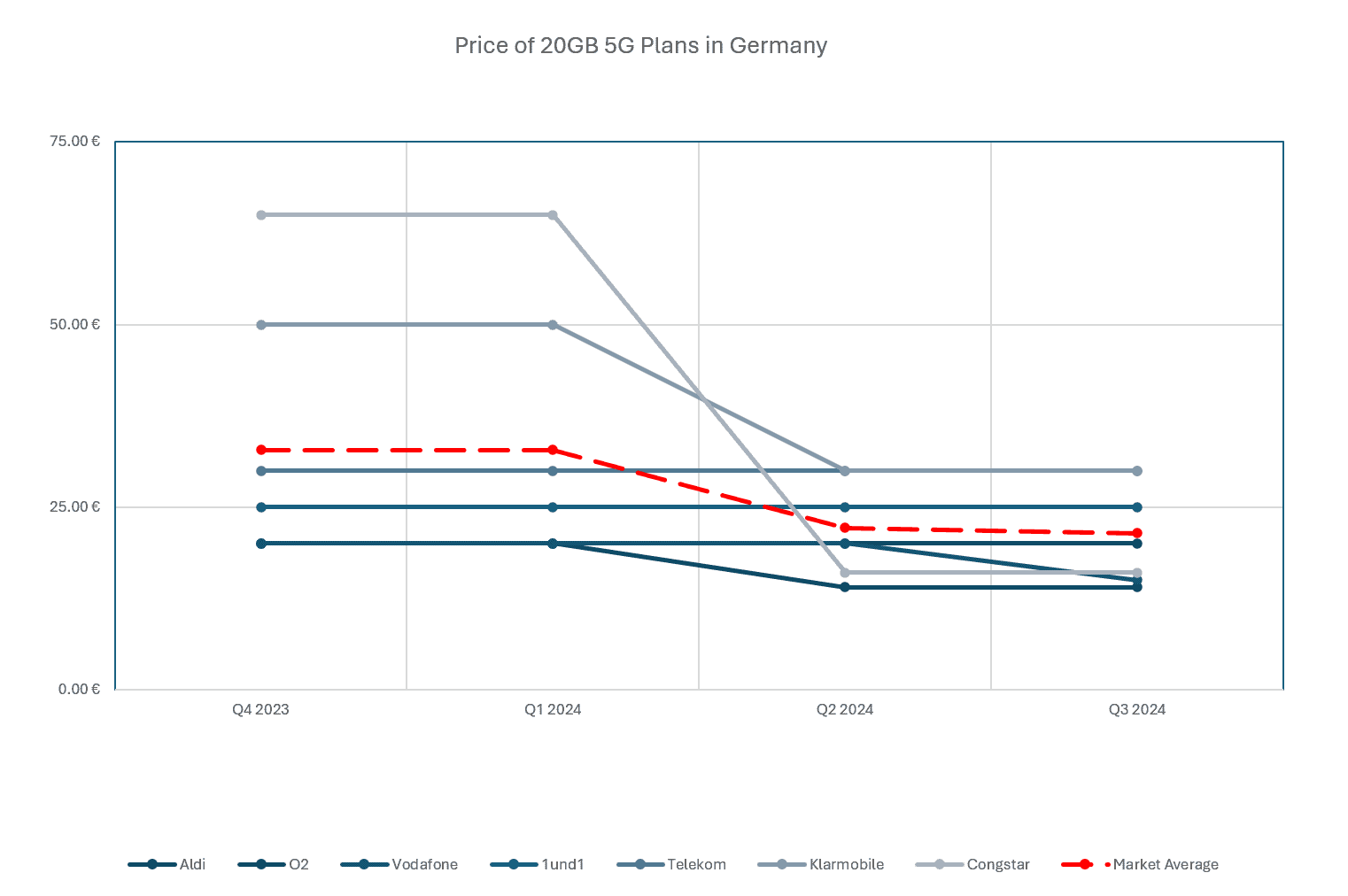

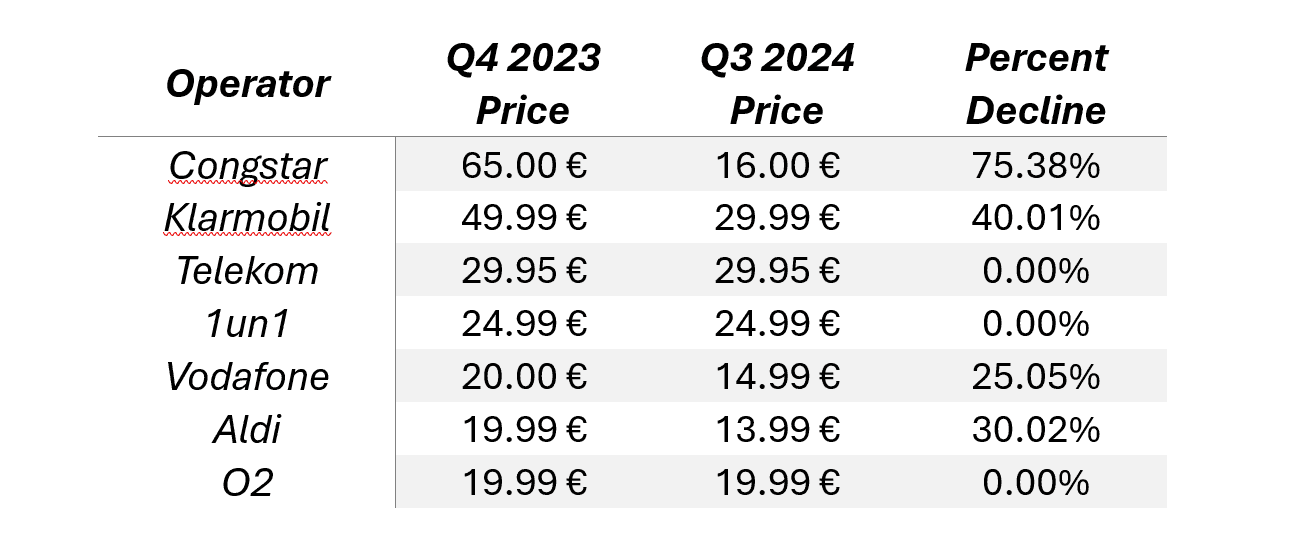

For example, even in Germany—a market traditionally known for higher costs and where operators have more pricing power—the prices for 20+GB of 5G data have fallen dramatically in the past year (see chart below).

While some operators were able to maintain their prices over the year, most saw significant declines. Just as concerning as these declines is the fact that prices across all providers now appear to be largely converging, much as they would for a commodity market. If this trend holds, then there is little reason not to expect this “race to the bottom” to continue across more user types in 2024-25.

The Next Domino to Fall: 100GB Plans

In the past quarter, Tarifica’s researchers have identified increasing activity in the 100+GB space. Across Europe, operators have been launching new offers targeting these users, raising the data volumes of existing plans to this level, or discounting their highest volume offerings. Collectively, these actions have driven down prices for this user group quite meaningfully.

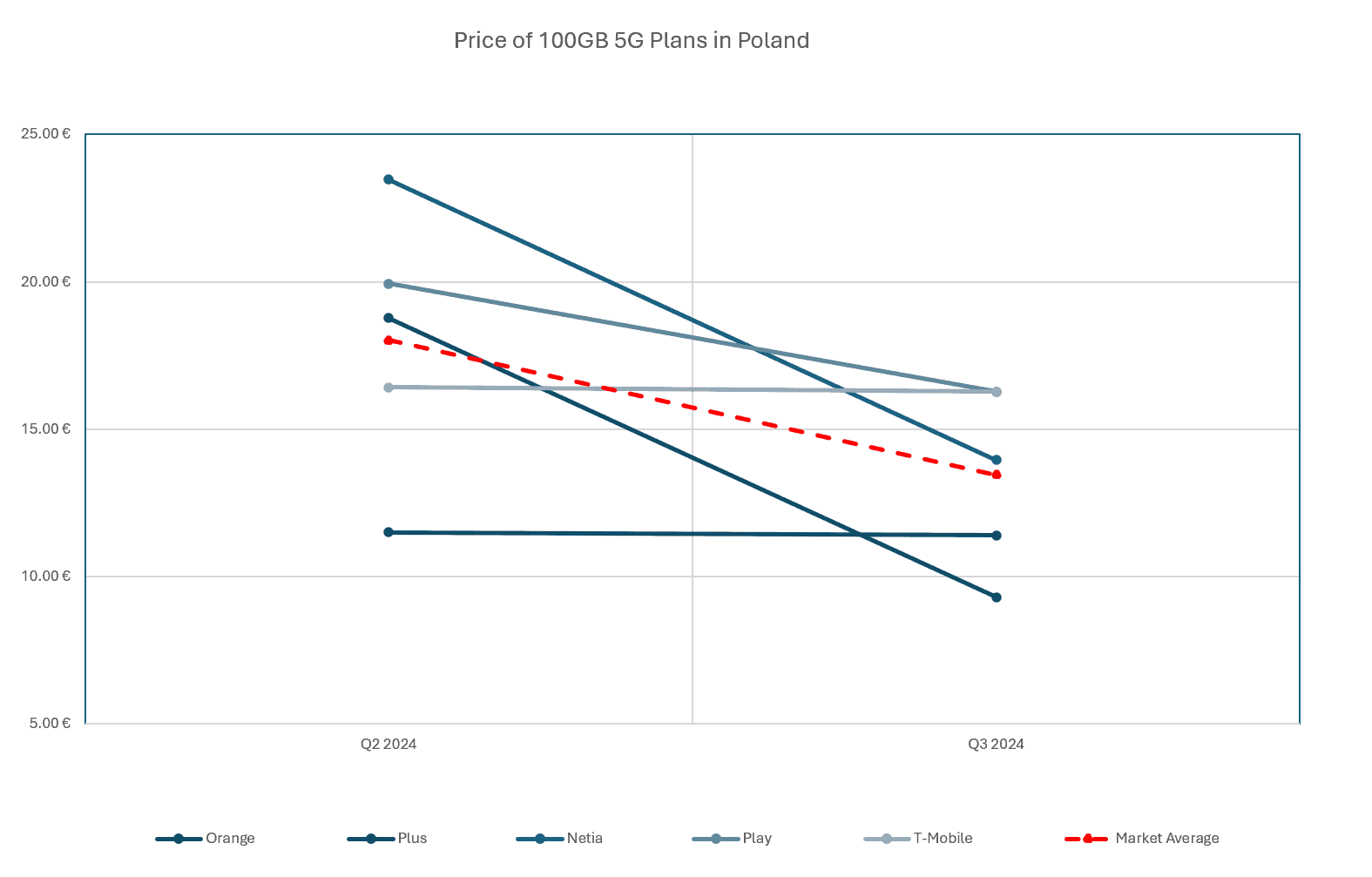

The most noteworthy example of this trend was Poland, where three operators – Play, Orange, and Netia – all saw prices drop by an average of more than 37% (see chart below).

While not as widespread as in Poland, operators in Belgium (Orange), Ireland (Tesco) and Spain (Yoigo) also saw price reductions ranging from 17% to 44% for 100+GB plans.

Importantly, all of these changes occurred just between Q2 and Q3 of 2024. If the analysis had been expanded to cover the whole of 2024, we would have seen even more price reductions in this segment globally.

Approaching the End of “More for More”?

In some ways, these changes are the inevitable consequence of the “More for More” strategy which telcos have embraced in recent years. To maintain ARPU in the face of intensifying competition, mobile operators opted to steadily increase data allowances and other features. In exchange, though operators were occasionally able to raise prices, the strategy was predominately aimed at holding fees steady.

While this strategy has been relatively effective to date, it does not do anything to enhance the underlying value proposition of mobile services. Instead, it serves to continuously reduce the per unit price, even as overall prices remain relatively unchanged.

With prices now beginning to fall sharply on this highest tier of 5G service, it is possible that operators are approaching the limits of “More for More”. While some operators may be able to push consumers towards the 250GB or even 500GB of usage per month and delay a little longer, there are simply very few individuals who actually use this much data on their mobile device on a monthly basis. Even with frequent video streaming and regular hotspot use, most individuals fail to exceed 100GB on a regular basis.

If operators persist with this strategy, they risk an increasing number of consumers realizing that they are already maximizing the value of their connection. As a result, the strategy will reach saturation where additional data or features no longer incentivizes customers to upgrade or pay more. At that stage, operators that fail to innovate or offer new, more compelling services will have no recourse but to drop prices or cede market share to competitors that do.

About the Author:

Will Watts

VP of Product

wwatts@tarifica.com

Will is responsible for the planning, build-out, and maintenance of Tarifica’s data solutions, including the flagship Digital Intelligence Platforms. In his more than 10 years at Tarifica, he has successfully delivered custom projects and market analyses to clients such as GSMA, the World Bank, BEREC, Verizon and Telefonica.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com