12-Country Study Finds Belgium Most Expensive European Market for Fixed Broadband Service

by Will Watts

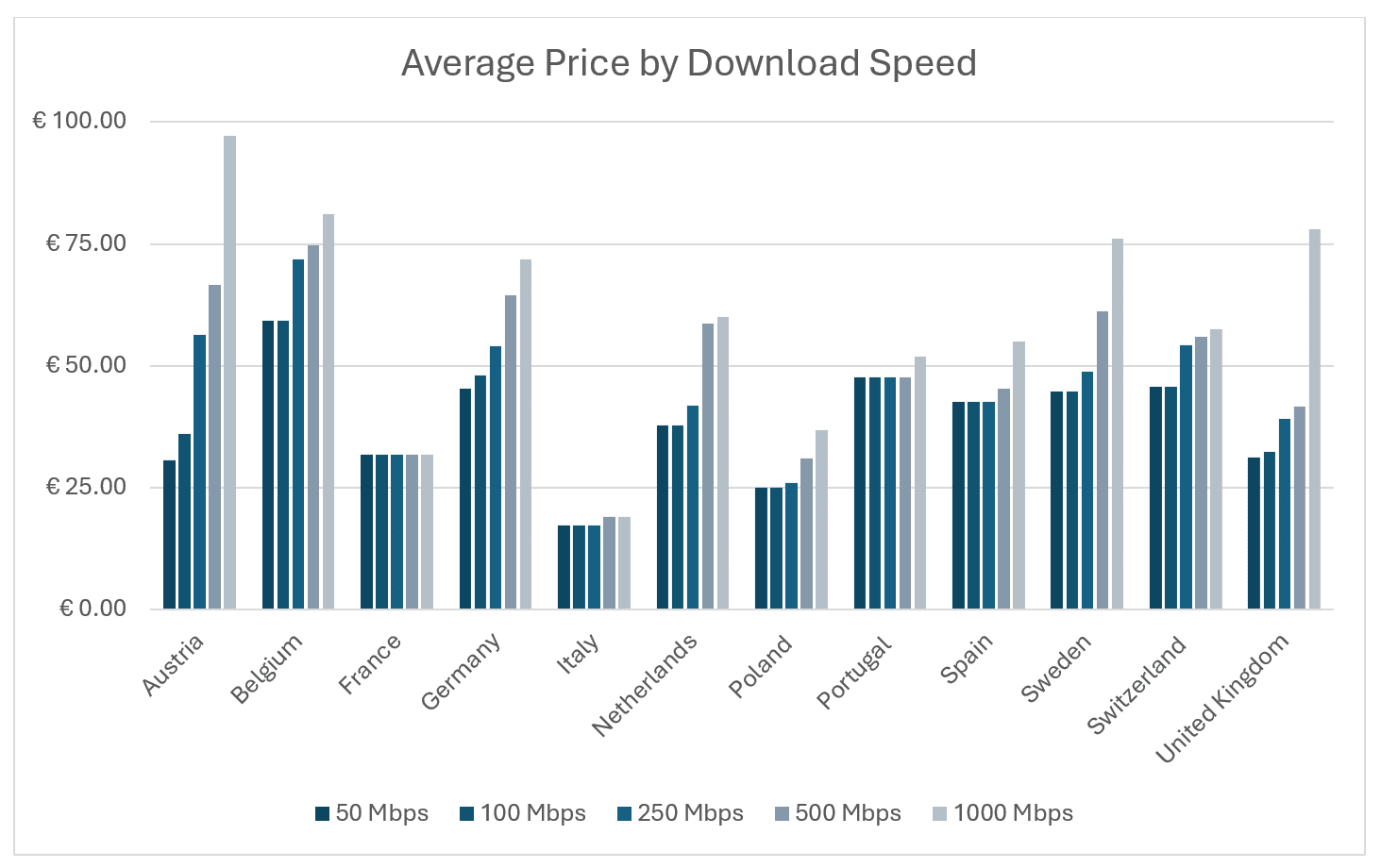

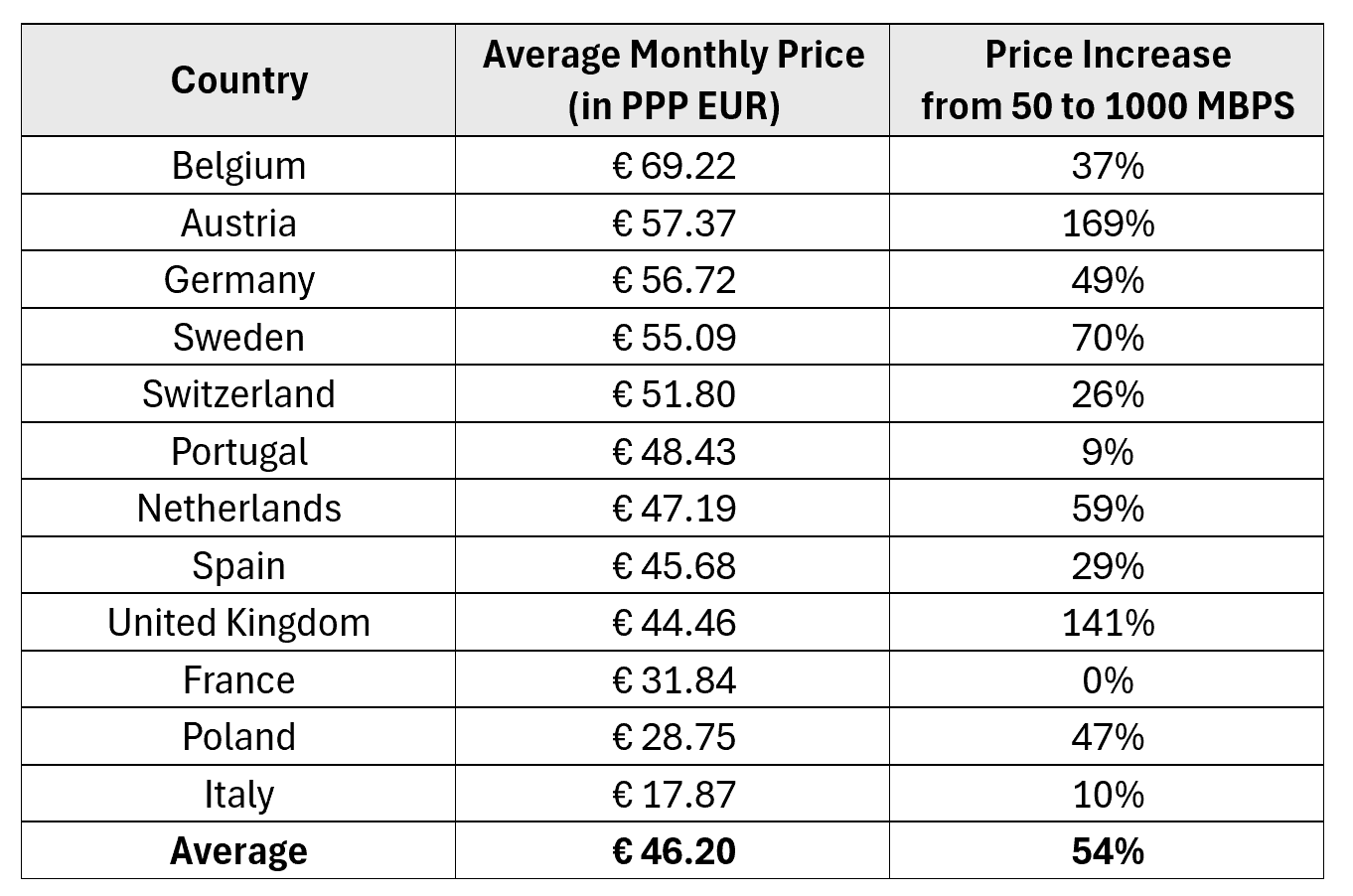

A study by Tarifica found Belgium to be the most expensive of 12 European countries reviewed, with average monthly costs of PPP €69.22 across the five consumer types studied. Other high- cost markets included Austria, Germany, and Sweden – which all had average costs above PPP €55.00 per month.

Between these expensive countries, however, there was significant variation in the cost drivers. In Austria, prices scaled dramatically as the requirements increased. For entry-level users who required only 50 Mbps, the average charge was only PPP €30.61 per month, making it the third cheapest market studied. For high usage consumers requiring 1000 Mbps or greater, however, the average monthly cost in Austria was PPP €97.23 – more than €15 higher than any other country. This contrasted with Belgium, which was the most expensive market for entry-level users at PPP €59.33 per month, but saw prices only increase by 37% when upgrading to 1000 Mbps download speeds.

On the other end of the pricing spectrum, Italy was the lowest cost market studied, with average monthly costs of only PPP €17.87 – more than 37% less than the next closest market. After Italy, Poland and France were grouped closely at PPP €28.75 and PPP €31.84, respectively. These countries were the only markets with average costs below PPP €40/month. Of these low-cost markets, France and Italy were linked by how little prices increased between consumer types (a sure sign of commoditization). France showed complete commoditization: providers charged identical prices regardless of whether customers selected 50 Mbps or 1000 Mbps plans. Italy showed similar commoditization, with only a 10% price difference across speed tiers. The Polish operators had a greater degree of pricing power as their plans increased in download speeds – with the country seeing an average of 47% higher prices for 1000 Mbps plans when compared to 50 Mbps plans.

Methodology

This study was completed using Tarifica’s Telecom Pricing Intelligence Platform (TPIP) benchmarking functionality.

For each country, every broadband provider (including mobile carriers with FWA options) offering home broadband plans with at least 50 Mbps download speeds was evaluated. To compare prices across providers, five consumer profiles were deployed to model the expected costs for different user types. The profiles were separated by the required download speed, with the thresholds set at 50+ Mbps, 100+ Mbps, 250+ Mbps, 500+ Mbps, and 1000+ Mbps. All profiles required unlimited data caps.

All data came from Q3 2025. Prices were calculated based on the advertised monthly cost.

About the Author:

Will Watts

VP of Product

wwatts@tarifica.com

Will is responsible for the planning, build-out, and maintenance of Tarifica’s data solutions, including the flagship Digital Intelligence Platforms. In his more than 10 years at Tarifica, he has successfully delivered custom projects and market analyses to clients such as GSMA, the World Bank, BEREC, Verizon and Telefonica.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com