Unlimited Gets the Headlines But the Core Data Ladder Shapes the Market: The Hidden Structure of Global Postpaid Data Portfolios

by Soichi Nakajima

At first glance, the global postpaid mobile market appears fragmented. Hundreds of data allowances coexist across operators and regions, ranging from fractional gigabytes to multi-terabyte caps and Unlimited propositions. Yet when analysed at scale, a far more structured picture emerges.

Using Tarifica’s Telecom Pricing Intelligence Platform (TPIP), this Data Dive analyses a Q4 2025 global dataset of 2,415 standard consumer postpaid plans across 46 nations, to explore how operators actually design their data portfolios, where competition is most intense, and what “Unlimited” really represents in commercial terms.

Unlimited: Highly Visible, Structurally Secondary

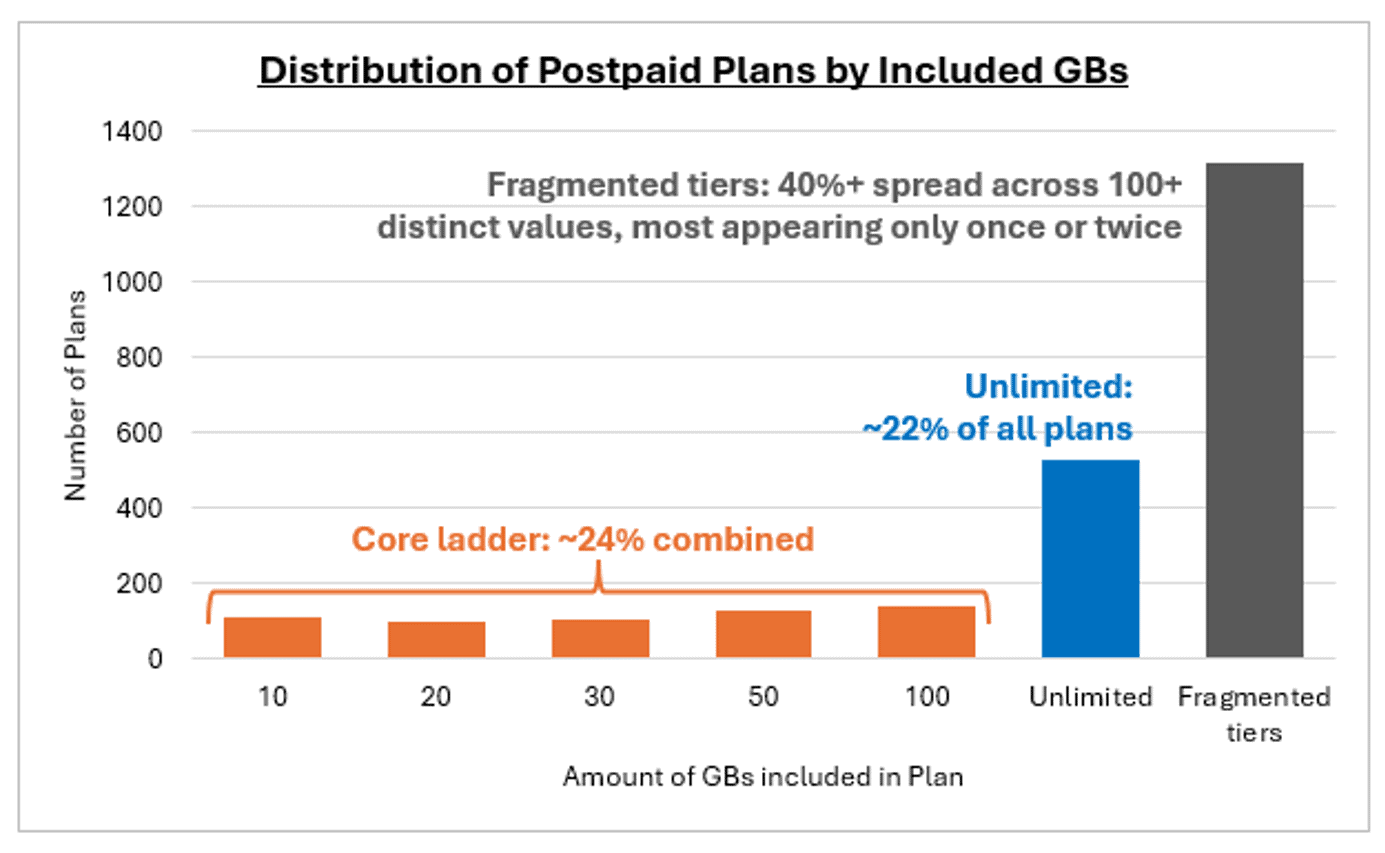

Unlimited plans account for 527 offers in the dataset, representing approximately 21.8% of all postpaid propositions.

Thus, despite their prominence in operator marketing, Unlimited plans remain in the minority. Nearly four out of five postpaid plans worldwide continue to rely on capped data allowances. This highlights a disconnect between perception and reality: while Unlimited is often presented as the future of mobile pricing, capped tiers still form the commercial core of operator portfolios.

In practice, Unlimited represents a single premium construct rather than a complete portfolio architecture on its own. Operators typically deploy it as a price anchor at the top of their range, supporting convergence strategies and signalling network strength. It frames value perception, but it does not replace the stepped data ladder that guides everyday customer choice.

Unlimited attracts attention; structure comes from elsewhere.

The Rise of a Global Data Ladder

When capped plans are examined more closely, clear structural alignment emerges across markets. Five data tiers dominate globally: 10 GB, 20 GB, 30 GB, 50 GB, and 100 GB. Together, these five allowances account for nearly a quarter of all postpaid plans in the dataset.

This is a striking result. While Unlimited represents roughly 22% of offers as a single category, these five capped tiers collectively represent a similar share — despite spanning five distinct product steps. This asymmetry is telling.

Operators across very different markets are independently arriving at the same portfolio design. A standard ladder of 10 / 20 / 30 / 50 / 100 GB has effectively become the global reference framework for postpaid data. These tiers simplify customer comparison, streamline merchandising, and enable predictable upsell journeys.

Notably, 100 GB is the most common capped allowance. What was once considered a premium data volume has quietly become the new benchmark for high-end capped plans, reflecting sustained growth in video consumption, social media usage, and cloud-based services.

In practical terms, this ladder defines the commercial core of the market. It is across these steps that operators compete on price, reposition value, and optimise portfolio migration.

So Unlimited may frame the top, but the 10–100 GB ladder shapes behaviour.

Beyond the Core: A Fragmented Long Tail

Outside the dominant ladder sits a highly fragmented segment representing more than 50% of all plans. This includes:

- sub-10 GB allowances

- irregular mid-tier values such as 25, 40, or 60 GB

- extremely large capped plans reaching several terabytes

Collectively, this segment contains over 100 distinct data values, most of which appear only once or twice across the entire dataset.

Although sub-10 GB plans may appear conceptually different from multi-terabyte offers, they behave the same statistically: low repetition, high diversity, and strong dependence on local conditions. These tiers are often shaped by regulatory constraints, legacy plans that remain technically active, and market-specific experimentation.

While this fragmented segment is large in aggregate, it does not reflect a coherent pricing strategy. Instead, it is primarily the outcome of local constraints and accumulated legacy decisions.

Meaningful competition concentrates around the standard 10-100GB ladder, where plan structures repeat and operators actively benchmark against one another. Beyond that core, most offers function as portfolio noise rather than evidence of deliberate global design.

A Consistent Three-Layer Market Structure

Taken together, the data reveals a remarkably consistent three-layer structure across markets:

- The commercial ladder (10–100 GB): The strategic core of postpaid portfolios, where most pricing pressure, value repositioning, and customer migration occurs.

- Unlimited: A premium anchor used for positioning, convergence, and brand signaling.

- Fragmented tiers (including sub-10 GB and ultra-high caps): A large but incoherent tail driven by local artefacts rather than structured competition.

This layered structure explains why operators can appear highly differentiated while, in reality, competing within a narrow design space. Most strategic decisions occur in the mid-tier, with Unlimited framing the top. Everything else reflects local complexity.

Conclusion

The global postpaid data market is far more ordered than it looks. Beneath hundreds of apparent options sits a tightly defined commercial core, built around a small set of standard data tiers and topped by a growing — but still minority — Unlimited segment. While more than 50% of plans fall into a fragmented long tail of over 100 distinct values, meaningful competition concentrates around a remarkably narrow ladder of 10–100 GB.

This matters because it exposes how operators actually compete. Pricing pressure, portfolio optimisation, and customer migration are driven not by endless choice, but by structural alignment around a shared commercial ladder, with Unlimited serving primarily as a premium anchor and fragmented tiers reflecting local complexity rather than strategic intent. Recognising this structure cuts through surface-level variety and reveals where commercial decisions truly play out, turning apparent chaos into a clear framework for understanding market dynamics.

About the Author:

Soichi Nakajima

VP Data and Analysis

snakajima@tarifica.com

With over 20 years of telecommunication market analysis experience, Soichi oversees the data collection, quality, research, analysis, and production of all data projects and quantitative studies.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com