Are All Unlimited Plans Created Equal? A Closer Look at European Mobile Data Pricing

by Soichi Nakajima

In a world increasingly reliant on mobile connectivity, unlimited data plans are often seen as the gold standard for consumers who never want to worry about running out of GBs. But just how comparable are these “unlimited” offers across markets—especially in Europe, where regulatory environments, infrastructure, and pricing strategies vary widely?

This month’s Data Dive explores that question by analyzing standard consumer mobile plans that include unlimited access to data in 17 European countries, using insights from Tarifica’s Telecom Pricing Intelligence Platform (TPIP). At first glance, one might expect straightforward comparisons: unlimited is unlimited, right? As the data shows, however, the reality is much more nuanced.

Average Prices Paint a Partial Picture

We begin by looking at the average price (in PPP-adjusted Euros) of the least expensive unlimited data plan from the major operators in each country.

The graph shows pricing data for 15 countries—France and Belgium are excluded because, as of Q1 2025, the main providers in those markets still did not offer unlimited plans. (One might joke that perhaps the French-speaking regions just don’t believe in “limitless.”)

Czechia, Greece, and Germany top the list as the most expensive markets for unlimited data, while Italy, Ireland, and the Netherlands offer the most budget-friendly options.

But averages can obscure just as much as they reveal. A lower-cost plan might exist alongside more expensive offers, skewing the picture. To get a clearer sense of what’s truly available to consumers, we also looked at the single cheapest unlimited plan available in each country from the same operators mentioned above—regardless of whether it was from a major player or a smaller operator.

Germany’s Outlier: A Case Study in Plan Complexity

The contrast between average and lowest available pricing is most striking in Germany. While the average price among major German operators is a steep €79, 1&1 offers an unlimited plan for just €20. A €60 difference begs the question: why wouldn’t all users switch to the cheaper option?

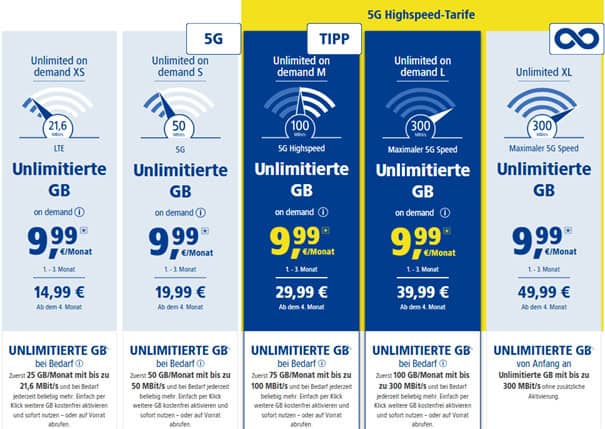

A closer inspection of 1&1’s “Unlimited On Demand XS” plan reveals some of the trade-offs.

Priced at €14.99/month (or €9.99/month for the first three months), it technically offers unlimited data—but only in 1GB increments after an initial 25GB allotment, and only at LTE speeds capped at 21.6 Mbps. Higher-tier plans offer faster speeds and 5G connectivity but at higher prices. So while the data is indeed unlimited, speed and convenience are limited.

Speed Caps: A Quiet Trend Across Markets

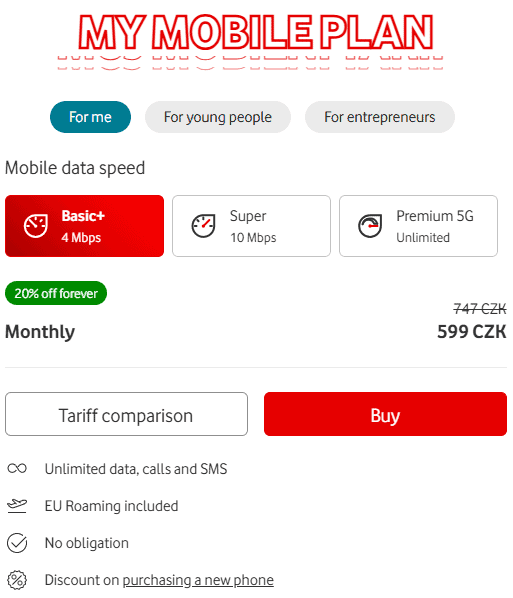

This model—where “unlimited” comes with speed restrictions—is not unique to 1&1. Germany’s O2 offers similar plans, though Telekom and Vodafone do not. In Czechia, another high-cost market, both Vodafone and O2 provide tiered unlimited plans where users can choose between capped speeds, depending on how much they’re willing to pay.

See below an example from Vodafone Czechia, where users can choose between 4 Mbps, 10Mbps, and max speed.

Conclusion: Why “Unlimited” Isn’t Always Unlimited

So, who really offers the cheapest unlimited plan in Europe? As we’ve seen, the answer depends on how you define “cheapest”—and how you define “unlimited.” Averages tell one story. The lowest advertised price tells another. But to make meaningful comparisons, one must dig into the details: speed restrictions, data throttling policies, and promotional pricing structures.

This isn’t just a matter of semantics—it has real implications for consumers and regulators alike. For users, a low price might come at the cost of performance. For regulators and analysts, comparing plan pricing across markets requires an understanding of the fine print, not just the headline figures.

Even among large, pan-European operators, there’s no one-size-fits-all strategy. Vodafone may offer restricted unlimited plans in the UK and Czechia, but in Germany its plans are not restricted. Meanwhile, O2 offers non-restricted unlimited plans in the UK, but its plans in Germany and Czechia are restricted. These inconsistencies reflect how pricing strategies are tailored to local market conditions, infrastructure constraints, and consumer expectations.

At face value, the idea of comparing unlimited mobile data plans across countries might seem simple. But as this analysis shows, the concept of “unlimited” is anything but uniform. From speed caps to data layering, plan structures vary widely—even within the same operator’s portfolio.

For consumers, this reinforces the importance of looking beyond the price tag. For industry players and policymakers, it’s a reminder that telecom pricing—especially when it comes to “unlimited” offers—requires careful scrutiny and contextual understanding.

In the end, unlimited doesn’t always mean the same thing. And that’s a limit worth keeping in mind.

About the Author:

Soichi Nakajima

VP Data and Analysis

snakajima@tarifica.com

With over 20 years of telecommunication market analysis experience, Soichi oversees the data collection, quality, research, analysis, and production of all data projects and quantitative studies.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com