Denmark Stands Out for Consumer Mobile Value in Study of Four European Markets

by Will Watts

In this edition of Tarifica’s Data Dive, we will discuss the results of our recent analysis, conducted using Tarifica’s Telecom Pricing Intelligence Platform (TPIP), of four mobile telecom markets in Europe: Belgium, Czechia, Denmark, and Portugal.

Key Findings

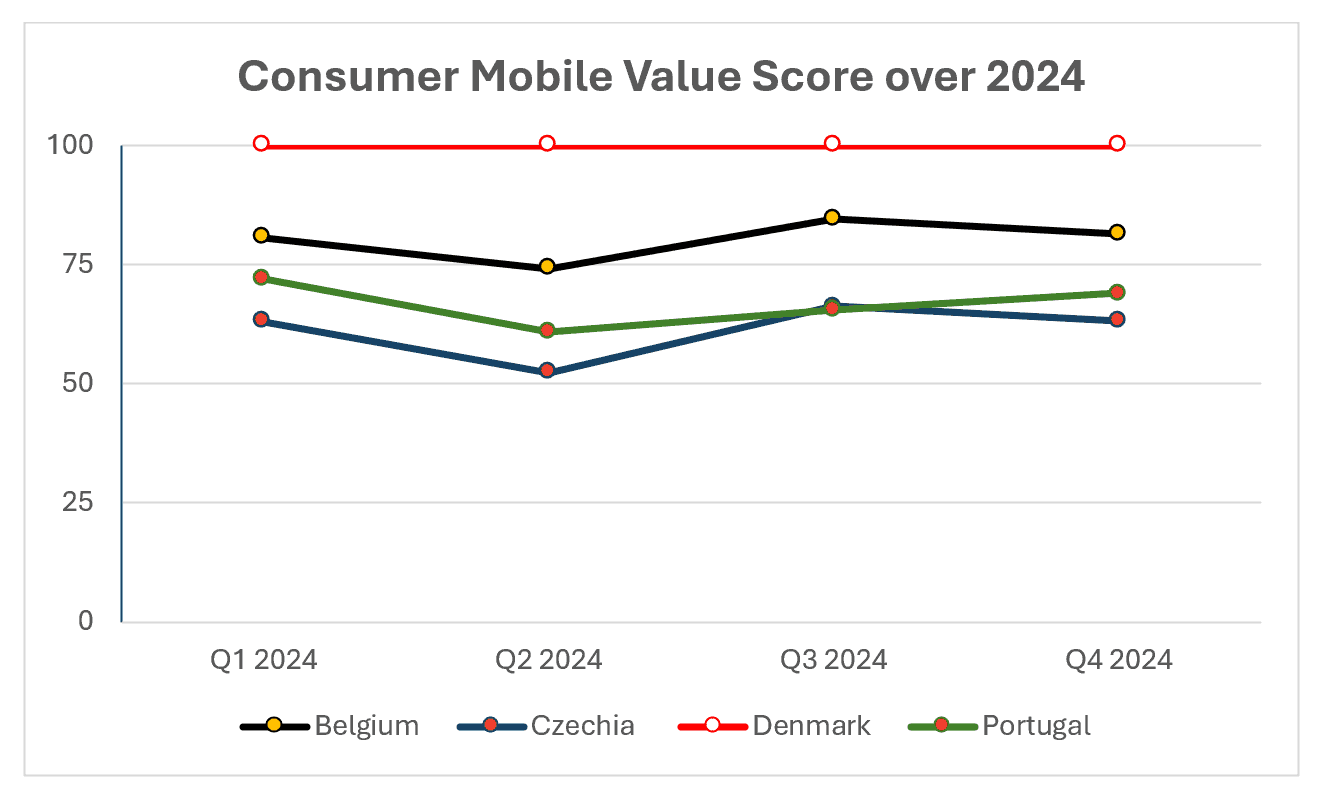

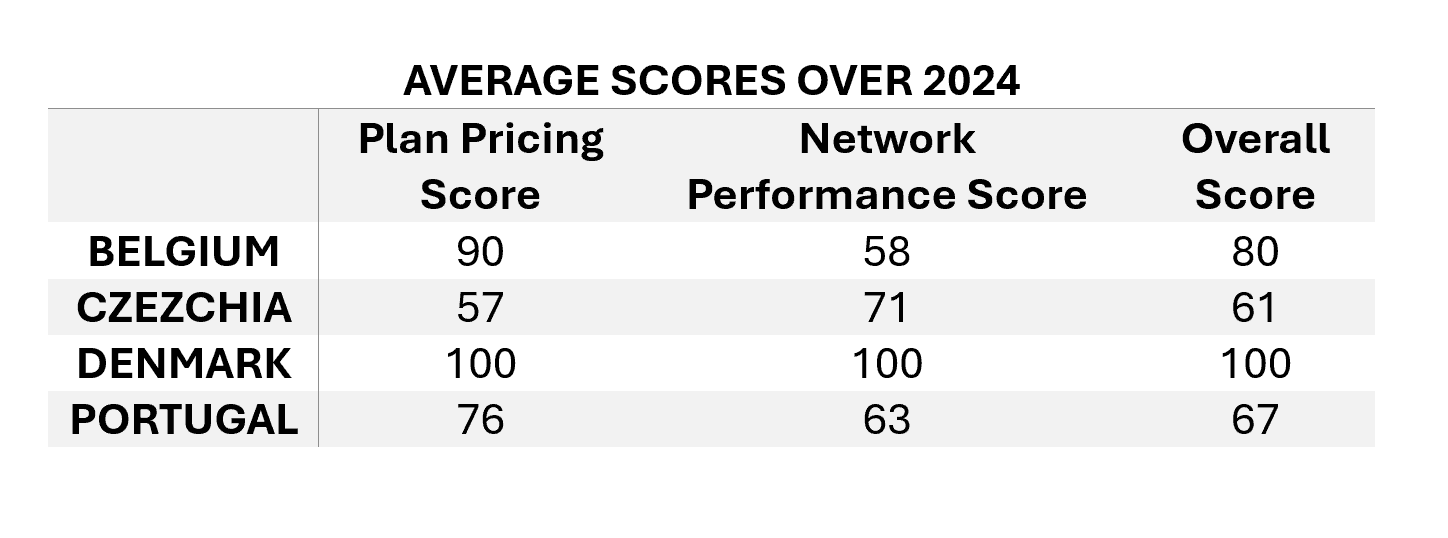

Of the four markets evaluated, Denmark stood out as the leading market for consumer value. The country was leading the market for both pricing (i.e., how much consumers get for their dollar) and network performance (e.g., download speed, etc.), scoring a perfect 100/100 for all quarters for 2024.

Of the other three markets, Belgium consistently placed second across 2024, with overall scores between 74 (in Q2 2024) and 84 (in Q3 2024). The country’s performance was driven by its strong scores in tariff pricing, where it averaged a score of 89 over the year. However, the country’s network performance, averaging only 58, dragged down the overall value of its plans.

The remaining two countries, Portugal and Czechia, were quite comparable over the year, though the former performed slightly better in three of the four quarters. That said, the underlying composition of their scores was rather different. Portugal scored reasonably well on the pricing element (with an average score of 76), but underperformed in terms of network performance. Czechia was the reverse of this, scoring reasonably well for network performance but the lowest of all countries for plan pricing (with an average score of 57).

Q4 2024 Pricing Highlights

Examining the most recent quarter of 2024 provides some additional insight into the pricing strategies of each country’s providers, as well as the overall pricing structures of the available mobile offerings across these four countries.

Three in Denmark stood out as the lowest cost operator out of the 13 examined in this study – with an average price of just US PPP $19.18 per month. This fee was over 20% less than the average price for service in Denmark (which was already the lowest cost market). Three Denmark also stood out in the lower usage segments, where it ranked the lowest cost provider for the three consumer types requiring the least usage. While there were some less expensive providers for the two highest-usage consumer segments, Three was still one of the lower cost providers for these users.

On the opposite end of the spectrum, T-Mobile and Vodafone in Czechia were the highest cost providers in the study, with average costs of US PPP $67.40 and $67.64, respectively. For T-Mobile, these high costs were driven by a lack of affordable options for lower usage consumers. In the most extreme example, the provider’s best option for budget users came in at US PPP $39.42 per month, which is more than 40% higher than the average price in Czechia for that user type. While Vodafone’s prices were more competitive for lower usage segments, the operator was consistently among the most expensive for the highest usage consumers. It was the only operator tracked which was above US PPP $100/month for both the “Mobile Streamers” and “All Around Heavy Usage” profile types. As a reference, the average cost for these two profiles across the study was closer to US PPP $60/month.

Methodology

This study was completed using the new multi-profile benchmarking feature on Tarifica’s Telecom Pricing Intelligence Platform (TPIP). This feature enables users to instantly calculate pricing for multiple consumer profiles at once and then combine these results into a singular price ranking for the whole country for either mobile or fixed broadband telecom service.

Beyond pricing, the system also generates a Network Performance Score, based on the average download speed, upload speed, and latency of the plans in the country. Ultimately, the combination of these two factors creates an all-in ranking for the consumer value delivered by the mobile or fixed broadband providers in a country.

This study used a weighted average of a plan pricing score and a network performance score. Since the plan pricing score has a greater impact on consumers’ accessibility to the mobile ecosystem, it represents a larger percentage of overall score.

In total, this study covered 13 mobile operators across the four selected countries.

Mobile Pricing Rankings and Profiles Employed

For the mobile pricing rankings, the following profiles were used to model different consumer types:

Each of these profiles was designed to reflect the regular monthly usage of a different segment of users in the mobile marketplace. For each profile, the price of service was collected from all operators tracked by TPIP in each of the four countries studied.

To create a single price for each country, the price from each consumer profile was multiplied by the operator’s market share, creating a weighted average price which is reflective of the expected costs of all consumers across the selected country.

To fairly compare the impact of these costs across markets where consumers are facing different purchasing environments, all costs were standardized to Purchasing Power Parity adjusted US dollars (PPP-USD).

Finally, the highest national score was scaled to 100 and all other countries were called by the same factor.

All of the above calculations were completed automatically within TPIP.

Network Performance Rankings and Profiles Employed

Consumer value is not only driven by the included features of a mobile plan and its associated costs but also the plan’s performance in the real world. Can the user stream videos without waiting for them to load? How long does it take to upload pictures to a social media site?

To measure this, Ookla’s data on national network performance was used. For each of the countries, the average download speed, upload speed, and latency were collected for every quarter of 2024.

Since these metrics have different impacts on the consumer’s mobile experience, these were combined using the following weightings: 70% download speed, 20% upload speed, 10% latency.

As with the price rankings, the results were scaled to a single 1-100 score for each country.

About the Author:

Will Watts

VP of Product

wwatts@tarifica.com

Will is responsible for the planning, build-out, and maintenance of Tarifica’s data solutions, including the flagship Digital Intelligence Platforms. In his more than 10 years at Tarifica, he has successfully delivered custom projects and market analyses to clients such as GSMA, the World Bank, BEREC, Verizon and Telefonica.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com