US Broadband Study: Weak Pricing Power Below 1Gbps, Big Premiums at the Top

by Will Watts

This study examines the offerings of 21 broadband providers across four U.S. cities (Boston, Kansas City, Minneapolis, and Seattle) to assess trends in consumer broadband pricing and availability.

The objectives were: (1) to understand the expected cost of home broadband service in the United States and how this varied across different user classes, (2) to evaluate how these trends vary across the country’s cities and regions, and (3) to assess the availability of super high-speed plans across providers.

Key Findings

500Mbps increasingly becoming the entry-level speed, however 1 and 2 Gbps still command price premium

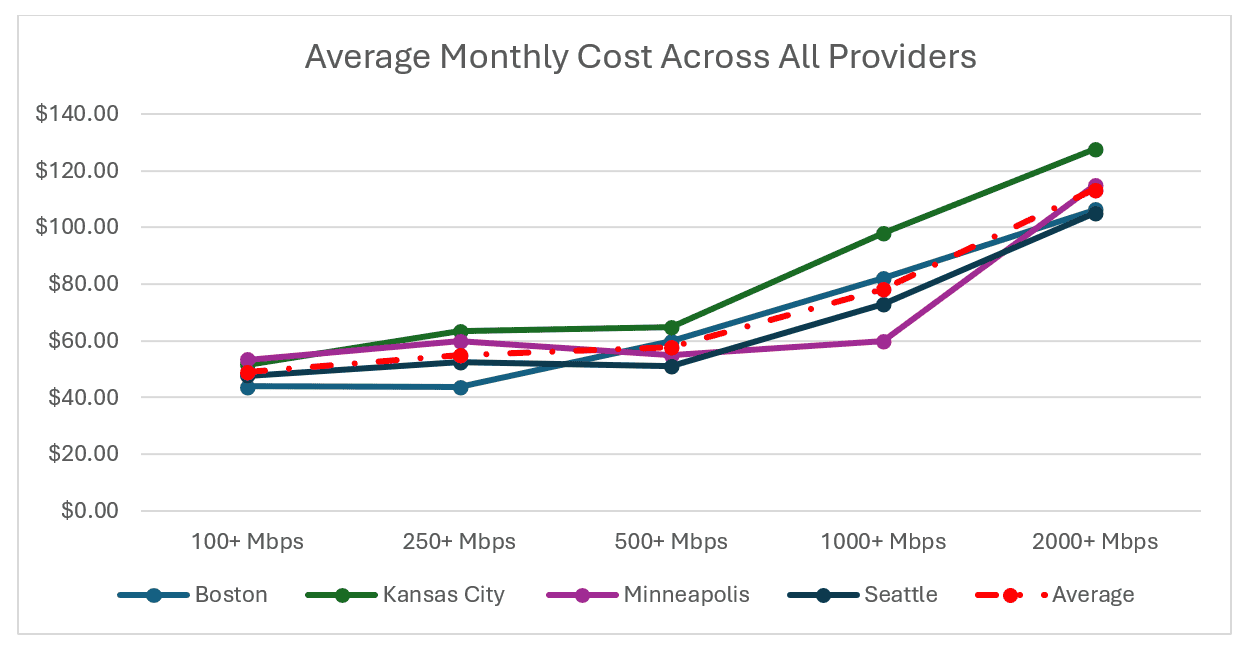

100Mbps had been the standard offering of broadband providers for years. However, in clear evidence that the US market had moved beyond the 100Mbps download speed plans, there was now almost no price increase between users requiring 100Mbps and those requiring 500Mbps. Across the 21 providers studied, the average monthly cost for plans with at least 500Mbps download speeds was only $8.55 more per month than the cost for 100Mbps plans ($57.66 to $49.11 per month).

After 500Mbps, however, there were dramatic price increases for additional bandwidth. Moving up to 1000Mbps increased the average monthly price by over 35%. Further, moving from 1000Mbps to 2000Mbps increased the average monthly cost by almost another 45% — effectively double the price of a 500Mbps plan.

This pricing power on high-speed broadband plans is likely driven by two factors. First, there appears to be meaningful consumer demand for high bandwidth on their home connections. These high-capacity plans are no longer just the domain of video gamers. Instead, given the combined demands from increased work from home (particularly Zoom meetings) and the desire to stream video on multiple devices simultaneously, many households now view 1Gbps+ as a standard requirement for their lifestyle – and are willing to pay a premium for it. Second, only a limited number of providers can deliver on these speed requirements. So providers that have these higher-speed connections available have more pricing power. While all 21 providers in the study could deliver 100Mbps plans, just 47% could offer download speeds of 1000Mbps and only 33% had 2000Mbps plans. Generally, there was only one or, at most, two providers per city with 2000Mbps plans available.

Some differences between operators – but similar pricing dynamics were present across all four cities

While the cities all had different broadband providers, each with its own plans and pricing strategies, the overall price dynamics between regions were quite similar. There was almost no difference in the pricing between Boston, Minneapolis, and Seattle, with the average monthly cost across all five profiles being separated by just $2.76 from the highest cost of these markets (Minneapolis) to the lowest cost (Seattle).

Kansas City stood out with the highest average monthly cost and was the most expensive market in four of the five profiles. Still, its average costs were only 23% higher than the lowest cost market studied – a meaningful increase but within the same overall price range. Moreover, as download speed requirements increased, the prices in Kansas City scaled by almost the exact same percentage as the other cities – indicating similar strategies and market dynamics at play, with just a higher base price point.

Methodology

This study was completed using Tarifica’s Telecom Pricing Intelligence Platform (TPIP) benchmarking functionality. Since the US market has regional broadband providers and prices are offered on a local level, the study compared four cities across the country: Boston, Kansas City, Minneapolis, and Seattle.

For each city, every broadband provider (including mobile carriers with FWA options) offering home broadband plans with at least 100Mbps download speeds was evaluated. To compare prices across providers, five consumer profiles were deployed to model the expected costs for different user types. The profiles were separated by the required download speed, with the thresholds set at 100+ Mbps, 250+ Mbps, 500+ Mbps, 1000+ Mbps, and 2000+ Mbps. All profiles required unlimited data caps.

All data came from Q4 2024. Prices were calculated based on the average cost over two years (with all start-up costs amortized).

About the Author:

Will Watts

VP of Product

wwatts@tarifica.com

Will is responsible for the planning, build-out, and maintenance of Tarifica’s data solutions, including the flagship Digital Intelligence Platforms. In his more than 10 years at Tarifica, he has successfully delivered custom projects and market analyses to clients such as GSMA, the World Bank, BEREC, Verizon and Telefonica.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com