Is 5G Still a Premium Service? The Data Says…

by Soichi Nakajima

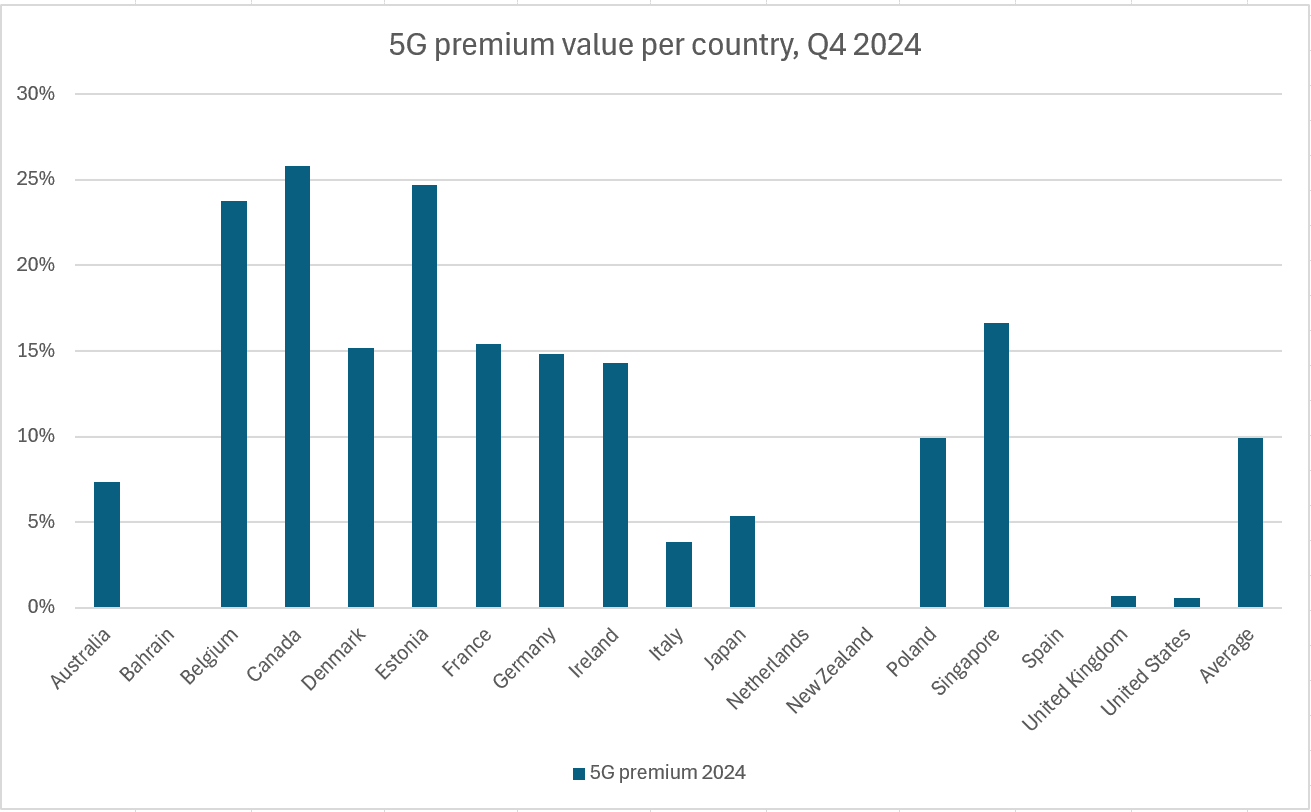

As 5G technology continues to roll out globally, an important question remains: does 5G still command a price premium over other mobile plans? To answer this, we analysed data from Tarifica’s Telecom Pricing Intelligence Platform (TPIP), focusing on 18 selected countries where 5G postpaid plans are available. By comparing the average monthly price of all postpaid plans with the average price of 5G postpaid plans in each country, we can assess the premium that consumers are paying for 5G.

Current 5G Pricing Trends

Our findings reveal significant variations in how 5G is priced across different markets. Canada leads with the highest 5G premium, where 5G plans are, on average, 26% more expensive than the average of all postpaid plans. Estonia and Belgium closely follow, each with a 25% premium. These figures suggest that in these markets, operators still see 5G as a premium feature worth charging extra for.

In contrast, some countries have moved toward eliminating the price premium for 5G for postpaid plans. Bahrain, the Netherlands, New Zealand, and Spain have a 0% 5G premium, meaning that there is no price difference between 5G and non-5G plans. Effectively, all postpaid plans in these markets now include 5G by default, signaling that 5G is no longer a differentiator but a baseline expectation.

Other major markets, including Italy, Japan, the UK, and the US, have relatively low 5G premiums. In these countries, most postpaid plans already include 5G as a standard feature, with only a few exceptions for low-end plans where a price differential still exists. Overall, the global average 5G premium stands at 10%. However, when excluding the four countries where 5G is now standard, this figure rises to 13%, indicating that while 5G is becoming more accessible, it still carries a premium in many parts of the world.

How Has The 5G Premium Changed Over Time?

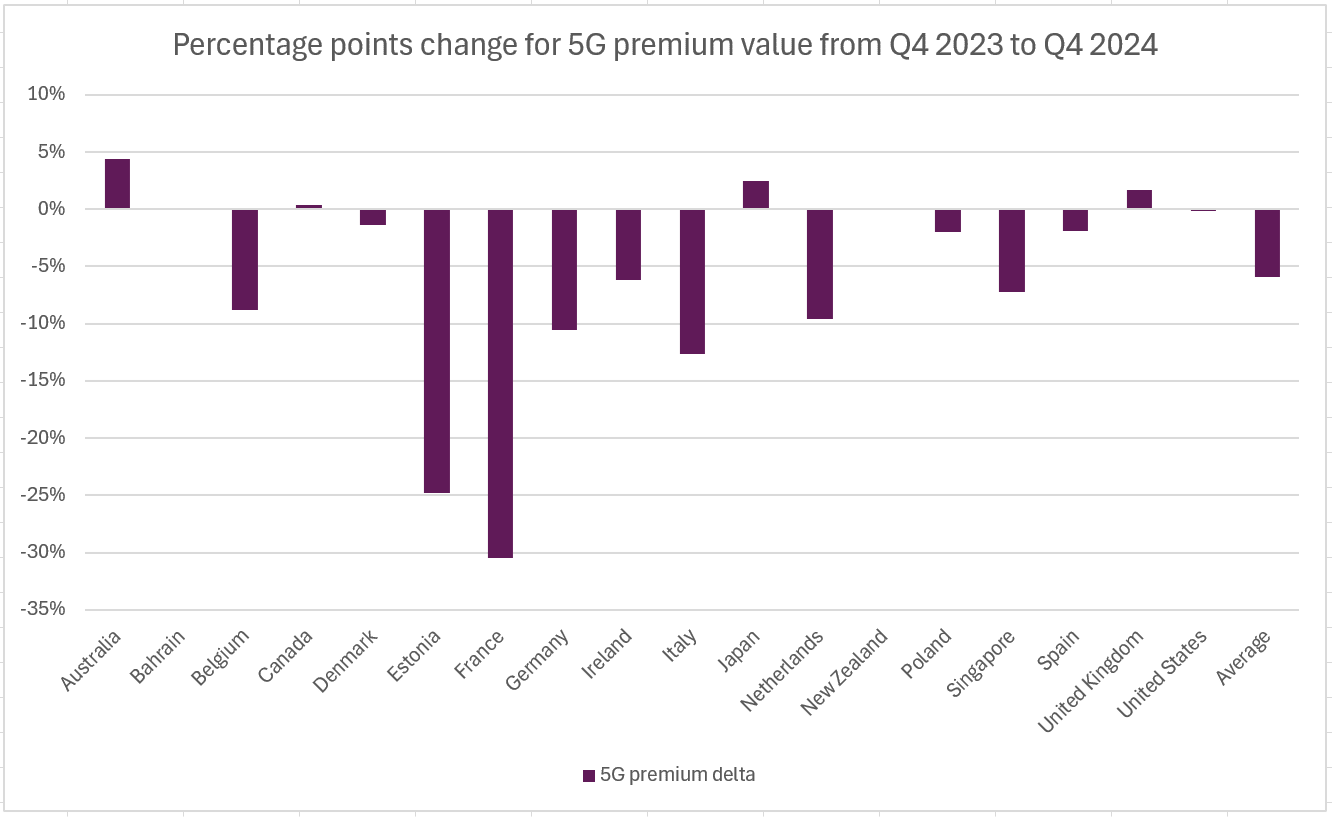

A year-on-year comparison from Q4 2023 to Q4 2024 provides further insights into the evolving landscape of 5G pricing:

France has seen the most significant drop in its 5G premium, falling from 46% in 2023 to just 15% in 2024—a dramatic 31-percentage-point decline. Estonia also experienced a notable decrease, with its 5G premium falling from 50% to 25%. Despite this drop, however, Estonia remains one of the highest-charging markets for 5G, suggesting that while 5G prices are decreasing, the premium still holds strong in certain regions.

While many countries have seen a decline in the 5G premium, some have experienced the opposite trend. Australia, Canada, Japan, and the UK recorded a slight increase in their 5G premium. These markets also witnessed an overall rise in postpaid plan prices, indicating that the increase in 5G pricing may be linked to broader shifts in mobile plan costs rather than a direct effort to sustain a premium for 5G services.

Meanwhile, the Netherlands provides an example of how quickly pricing structures can change. In 2023, Dutch operators were charging a 10% premium for 5G. However, by the end of 2024, that premium had disappeared, with all postpaid plans including 5G as the default. This shift mirrors a broader industry trend where more markets are phasing out the distinction between 5G and non-5G plans.

On average, the global 5G premium has dropped by 6% over the past year. Many countries have seen reductions in the range of 5% to 10%, reinforcing the trend that 5G is becoming more accessible and less of a premium-tier service.

Conclusion: Is 5G Still Premium?

The pricing of 5G remains a significant factor in mobile plan tariffs. As highlighted by our data analysis, 5G plans still command a premium over non-5G plans. However, this premium is clearly on a downward trend. Over the past year, the average 5G premium has declined from 16% in 2023 to 10% in 2024, reflecting a steady move toward price parity between 5G and traditional mobile services.

Countries like the Netherlands have joined Bahrain, New Zealand, and Spain in making 5G the default standard for postpaid plans. This shift suggests that, in some markets, consumers are no longer being charged extra for 5G access, but rather, it is becoming an inherent feature of mobile service offerings.

This analysis provides a macro view of 5G premium pricing. However, while pricing is a key consideration, it is not the only way operators differentiate within the 5G segment. Beyond cost, factors such as data allowances, speed prioritisation, premium access, and exclusive add-ons play a significant role in shaping the consumer experience.

As 5G adoption accelerates and pricing structures continue to evolve, Tarifica remains committed to delivering deep, data-driven insights to help operators and consumers navigate the evolving mobile pricing landscape.

About the Author:

Soichi Nakajima

VP Data and Analysis

snakajima@tarifica.com

With over 20 years of telecommunication market analysis experience, Soichi oversees the data collection, quality, research, analysis, and production of all data projects and quantitative studies.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com