From Highs to Lows: 5G Pricing Dynamics in Four Key European Markets

by Will Watts

While 5G technology has been widely available across advanced markets for several years, there are still wide discrepancies in both the available offers and pricing structures across countries and operators. This was the key takeaway from Tarifica’s recently completed study of 5G mobile pricing trends from 2022 to 2024 across four European countries: France, Germany, Netherlands, and Spain. Its objective was to track how 5G offers have evolved since the service’s launch and to analyze the various pricing strategies which are being employed within each of these markets.

The study had three core findings:

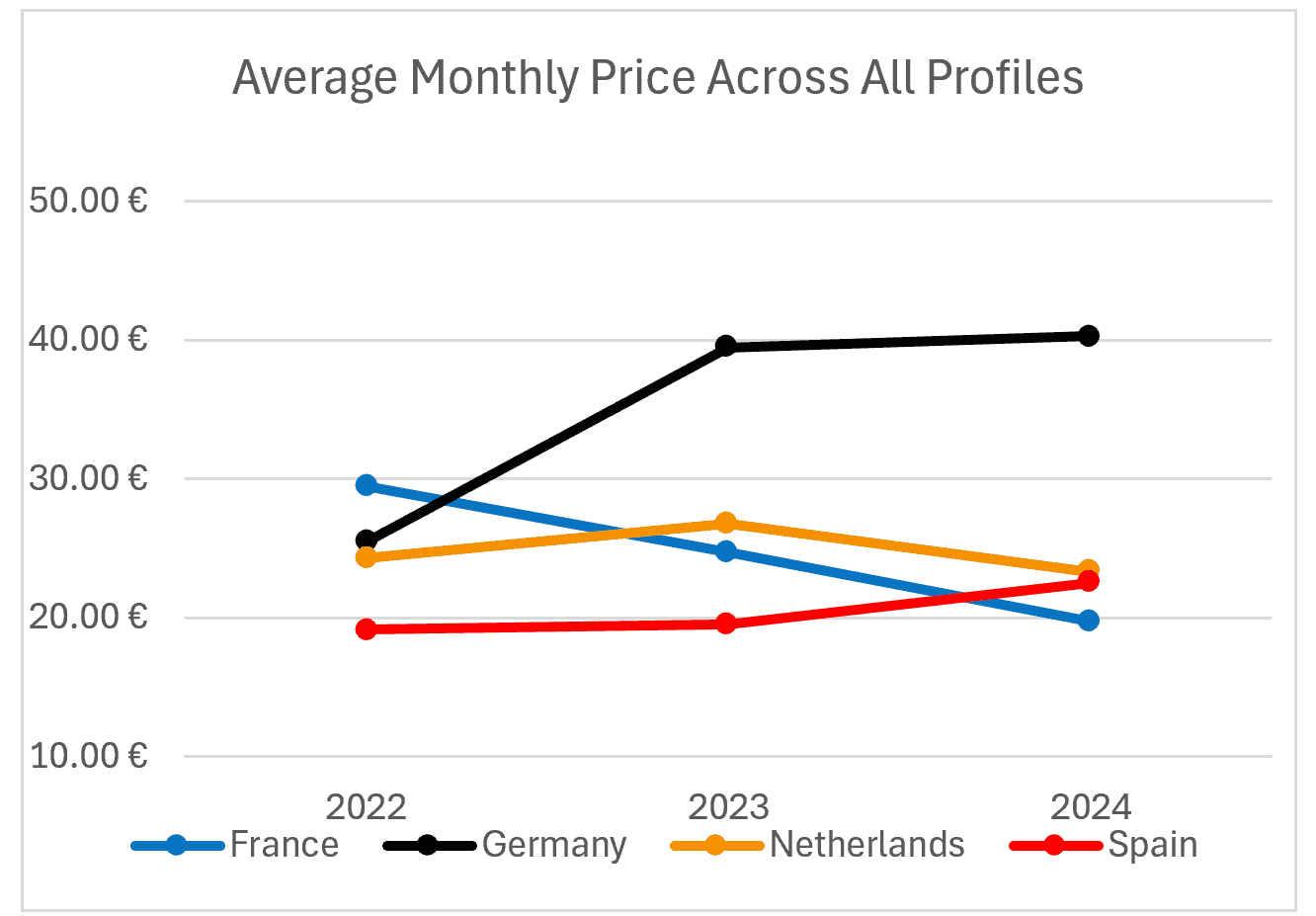

- 5G prices are moving in different directions depending on the market – Germany and Spain saw average prices for 5G mobile plans increase since 2022, while France and the Netherlands both registered price declines.

- Wide range of approaches to pricing structure, particularly for high data volumes – Some operators have carried over an “all unlimited” pricing model from their 4G plans to the 5G environment. As such, prices are relatively flat and the cost for base users is not too different than the price for super users. Other operators offer a wide range of plans for 5G customers, leading to prices that scale more linearly as a consumer’s usage increases.

- Evidence of commoditization of 5G already present in some markets, but not all – Concerns about the increasing commoditization of telecommunication services has been a hot topic in the industry even before the launch of 5G. Some markets, the Netherlands in particular, appear to validate these concerns, since there were almost no price differences between the providers. This was not the case everywhere, however. In markets like Spain and Germany, there were fairly significant price differences between competing operators, indicating that there were more factors shaping consumers’ decisions than pricing alone.

The unifying theme of these three findings is that, while 5G has now been widely available in Europe for several years, the market for it is still quite far from full maturity. There are wide differences in pricing, offer structure, and features both across countries and between providers within the same country.

Study Details

This study was conducted using data from Tarifica’s Telecom Pricing Intelligence Platform (TPIP), which contains an archive of all consumer mobile offers from 17 MNOs and large MVNOs across the four countries. All offers in the system were captured from provider websites and have been updated on a quarterly basis. For each year, data from the second quarter was used.

Since operators’ pricing and offer structure can vary dramatically between different user types, multiple consumer profiles were employed, each with a different set of requirements. In this study, three data volumes were employed: 5GB, 20GB, and 50GB. 5G speeds were required. In addition to the data allowance, each profile required 100 minutes of calling.

As is standard for benchmarking studies, these requirements represent the minimums for each profile – hence a plan with 10GB of data could still be selected for the 5GB profile (if it was the least expensive qualifying plan from the operator).

Finding 1: 5G Prices Rising in Germany and Spain, but Falling in France and the Netherlands

In two of the markets studied, the cost of 5G grew over the 2022-2024 period. Germany saw the most significant changes of any country, with the average cost of 5G mobile service increasing from €25.41 to €40.31 per month. These price increases made Germany the most expensive market for 5G service of all the markets studied.

Spain also saw prices rise, but the changes were much more modest, with prices increasing by only an average of €3.32 per month.

Each of the other two countries, France and the Netherlands, saw the price of 5G service decrease over the last two years. While the Netherlands saw only slight price reductions (down 4%), the changes in France were more dramatic, with 5G prices falling by over 33%.

Collectively, these changes have a major impact on the effective price paid by consumers. For example, in 2022, France’s average monthly cost was higher than Germany’s but by 2024 the market was over €20 per month cheaper.

Finding 2: Wide Variance in Operators’ Approaches to Price Scaling with Increasing Data Volumes

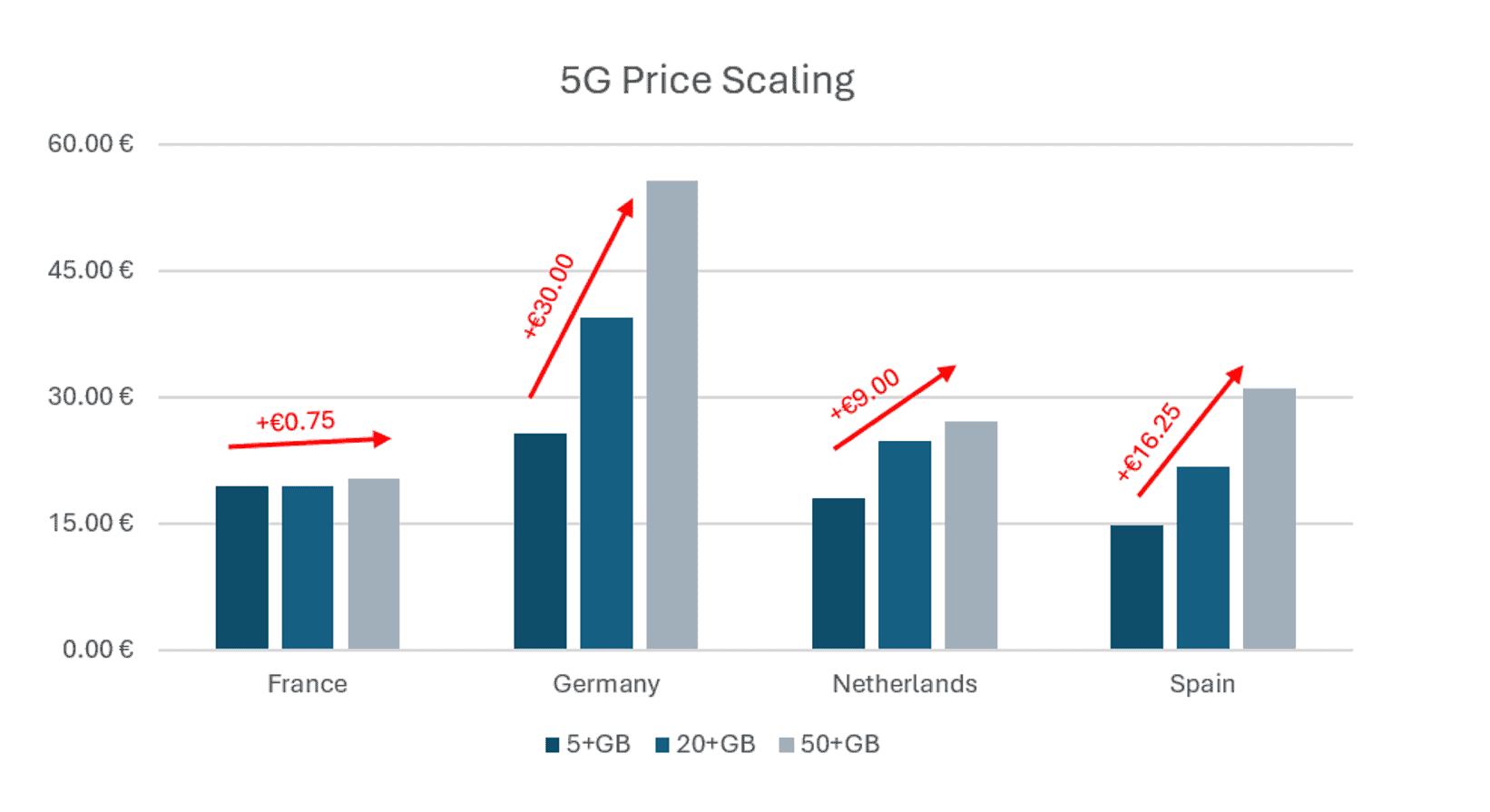

Strategically, the area of greatest divergence between the operators in the study was the extent of discounting as data allowances increased. In some countries, operators offered relatively few 5G plans, nearly all of which generally had high data volumes. So, for example, if the least expensive plan offered 50GB of data, someone who used only 5GB per month would pay the same amount as someone who used the full 50GB. In contrast to this strategy, some operators offered a broader range of 5G mobile plans – each with a different data volume and other included features. In these cases, the prices tended to scale more linearly as the monthly data volumes increased.

In terms of these types of volume discounts, the countries studied fell into three categories:

- Flat Prices for All Providers – In France, there were almost no price differences for consumers as they increased their usage of mobile data. For three of the four providers, there was no change for increasing one’s data usage from 5GB to 50GB per month. For the final provider, Bouygues, the price increase was only €3.00 per month.

- Limited Price Scaling – While prices in the Netherlands were not as flat as in France, the scaling was still somewhat modest, with the price of 50GB plans being an average of only 50% more expensive than 5GB plans. When subdividing further between moving from 5GB to 20GB and from 20GB to 50GB, all three operators increased their prices more on this first jump – generally, there were entry-level data plans in this market for low usage consumers – but had very modest increases between 20GB and 50GB, with an average price increase of only €2.17 per month.

- Near Universal Price Scaling – In Germany and Spain, almost all operators offered limited volume discounts and had pricing that scaled linearly with their plans’ data allowances. Spain’s prices increased an average of 110% between 5GB to 50GB. Germany’s scaling was slightly more pronounced, with an average price increase of over 115%. Importantly, for both countries, these price increases were distributed across all profiles. Operators had many different plans, and each step up in data usage came at a price.

Finding 3: Netherlands Highly Price Competitive While Operators in Germany and Spain Able to Differentiate on Other Plan Attributes

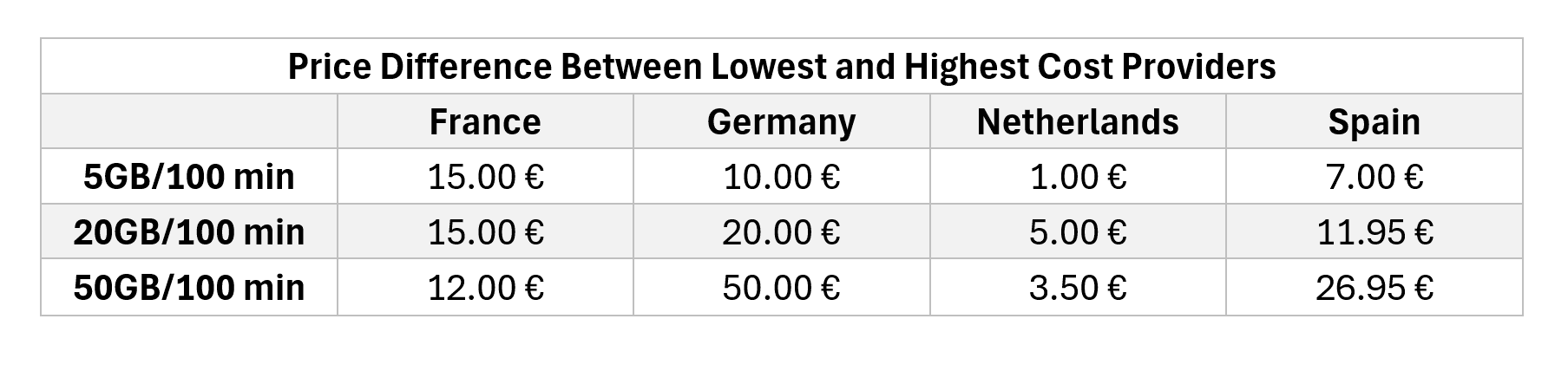

Substantial differences between the four countries were also found in how much internal variation there was between each of the competing operators. In some markets, there was very little price separation between the providers, indicating that 5G service might already be seen as a commodity. In other countries, there was a much larger range of prices, suggesting that the operators there were still able to differentiate their offerings on factors other than cost.

Interestingly, this trend somewhat aligned with the degree of volume discounting. In countries where there was a wide variety of plans, there tended to also be the greatest internal pricing variance between operators. This variance was particularly noticeable at the highest data volumes.

The most extreme version of this phenomenon can be seen in Germany. As an example, for German consumers who used at least 50GB of 5G data per month, there was a €50.00 difference between the best offer from Vodafone and that of 1un1. The same trend was evident in Spain, albeit to a less extreme degree. These ranges can be seen on the chart below which shows the price separation between the lowest and highest cost providers for each of the three consumer types.

Contrasting this was the Netherlands, where there was almost no price difference between the three operators for any of the three user profiles. For all consumer types, the price difference between operators would only be a few euros.

While the price separation between providers in France was greater than in the Netherlands, it remained relatively consistent throughout the usage spectrum and decreased at the highest data volumes. The prices for each of the French operators were essentially fixed and changed little for any user type.

About the Author:

Will Watts

VP of Product

wwatts@tarifica.com

Will is responsible for the planning, build-out, and maintenance of Tarifica’s data solutions, including the flagship Digital Intelligence Platforms. In his more than 10 years at Tarifica, he has successfully delivered custom projects and market analyses to clients such as GSMA, the World Bank, BEREC, Verizon and Telefonica.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com