Beyond Wires: FWA vs Fiber in Pricing and Performance

by Soichi Nakajima

In this edition of Tarifica’s Data Dive, we delve into our flagship Telecom Pricing Intelligence Platform (TPIP) to gather insights on Fixed Wireless Access (FWA) plans and compare them with their fiber alternatives. How do their speeds and prices stack up against each other? What factors should we consider? And ultimately, which offers better value – FWA or fiber?

FWA enables seamless broadband internet connectivity through a mobile network, eliminating the need for physical cable infrastructure to individual homes. This is particularly significant in rural areas where population density is low, making traditional cable-laying economically unfeasible for operators.

With the advancement of 5G technology, FWA has garnered increased attention. By integrating 5G into FWA, providers can avoid the hassle of cable installation and offer consumers internet speeds comparable to wired broadband with the simplicity of a plug-and-play setup.

Deep Dive by Country

United States: Leading with Fiber, But 5G FWA Shows Promise

In the United States, the push for nationwide connectivity has spurred interest in 5G FWA as a solution for areas where laying physical cables is impractical. The chart below plots the FWA and fiber offers from AT&T and Verizon, based on the monthly price (y-axis) and the advertised maximum speed (x-axis). While T-Mobile is the third major carrier in the US, they don’t offer any fiber plans, and were therefore excluded from this analysis. Their only consumer FWA plan is comparable to Verizon’s lower-priced FWA plan, with only slightly lower speeds (245Mbps compared with 300Mbps).

As seen in the chart, both AT&T and Verizon offer a mix of FWA and fiber plans. In most cases, fiber and FWA plans appear comparable in terms of price and download speed. However, although not shown on the chart, fiber generally outpaces FWA in terms of upload speed and reliability.

Looking at each operator, we can see that AT&T’s FWA plans offer lower download speeds at a slightly higher price when compared to their fiber plans, which positions FWA as a less appealing option. However, Verizon’s 5G FWA plans are actually the lower-priced option compared with fiber, which could particularly benefit those in areas without fiber availability, who are often used to paying higher prices due to the lack of connectivity alternatives. Additionally, with download speeds of up to 1Gbps, FWA presents Verizon’s customers with a viable alternative to traditional wired broadband. However, given the comparable price and download speeds between the two, it could be fiber’s symmetrical upload and download speeds that become the deciding factor for users with more demanding internet needs.

Thus, while 5G FWA does have an advantage in terms of coverage and simple plug-and-play setup, when it comes to connectivity, fiber appears to offer US customers more value for the money.

Germany: A Complex Landscape with FWA Versatility

Compared to the US, Germany presents a more complicated landscape. The chart below shows the FWA and fiber offers from the three German MNOs: O2, Telekom and Vodafone.

In Germany, FWA plans come in a range of speeds from all three MNOs, making them suitable for most users. Unlike fiber plans, however, German FWA plans typically come with a monthly data cap. Even though the lowest of these is 100 GB, which should be sufficient for most users, the mere presence of a data cap could make them less attractive than fiber plans, which don’t impose any limits.

While fiber plans generally offer faster speeds, FWA plans stand out for flexibility. O2’s FWA options are particularly distinctive, with their lowest priced FWA plan being the cheapest option when compared to its competitors. O2 also offers uncapped FWA plans by default, and they are the only German provider to offer FWA plans without a long-term contract. In contrast, the fiber plans of all three operators require long term contracts.

For users seeking moderate speeds and data allowances, FWA can be a cost-effective alternative to fiber, especially considering the shorter contract terms and diverse bundle options available. However, it is essential to note that, despite FWA’s greater flexibility and generally lower prices, fiber still offers significantly faster speeds, and without any data caps. With fiber, users can easily increase their speeds for an additional EUR €5.00 per month, allowing them to far outpace even the fastest FWA plan, making them more attractive to users with high bandwidth demands.

France: Fiber Reigns Supreme, FWA Plays a Niche Role

So, is Germany representative of all Western Europe? To compare, we will now take a look at France and three of its MNOS offering both FWA and fiber plans: Bouygues, SFR and Orange. Like T-Mobile in the US, Free offers FWA plans, but no fiber plans, and was therefore excluded from this analysis.

As the chart above demonstrates, in France, fiber has the advantage over FWA. In France, fiber is only obtainable as part of a triple-play plan also offering TV and fixed line voice calling, and its upload speed is just as fast as its download speed. In fact, the least expensive fiber plan from Bouygues (the full triple play price) is both cheaper and faster than the lowest end FWA plans from all three operators.

Fiber plans dominate the French market, offering additional included services and high-speed internet with symmetric upload and download rates. FWA plans, despite providing wide coverage and easy installation, generally lag behind fiber in terms of speed and overall value.

SFR is particularly representative of fiber’s dominance. The operator doesn’t have a 5G FWA plan, but instead offers an 8Gbps fiber plan, which is significantly faster than its rivals’ maximum fiber speeds. SFR’s choice to focus on super-fast fiber rather than widespread FWA coverage underscores the French market’s preference for fiber-based solutions.

While FWA plans may appeal to users seeking short-term contracts or easier installation, fiber remains the preferred choice in France for its superior performance and bundled services. Despite this, however, FWA still serves a niche role in the country, appealing to those looking for short-term contracts, coverage in more remote areas and easier installation.

Conclusion

In our exploration of Fixed Wireless Access (FWA) and fiber plans across various countries, it’s evident that both technologies play crucial roles in expanding internet connectivity and bridging the digital divide. While fiber offers unparalleled speed and reliability, FWA presents a compelling alternative, particularly in regions where laying physical cables is impractical or cost-prohibitive.

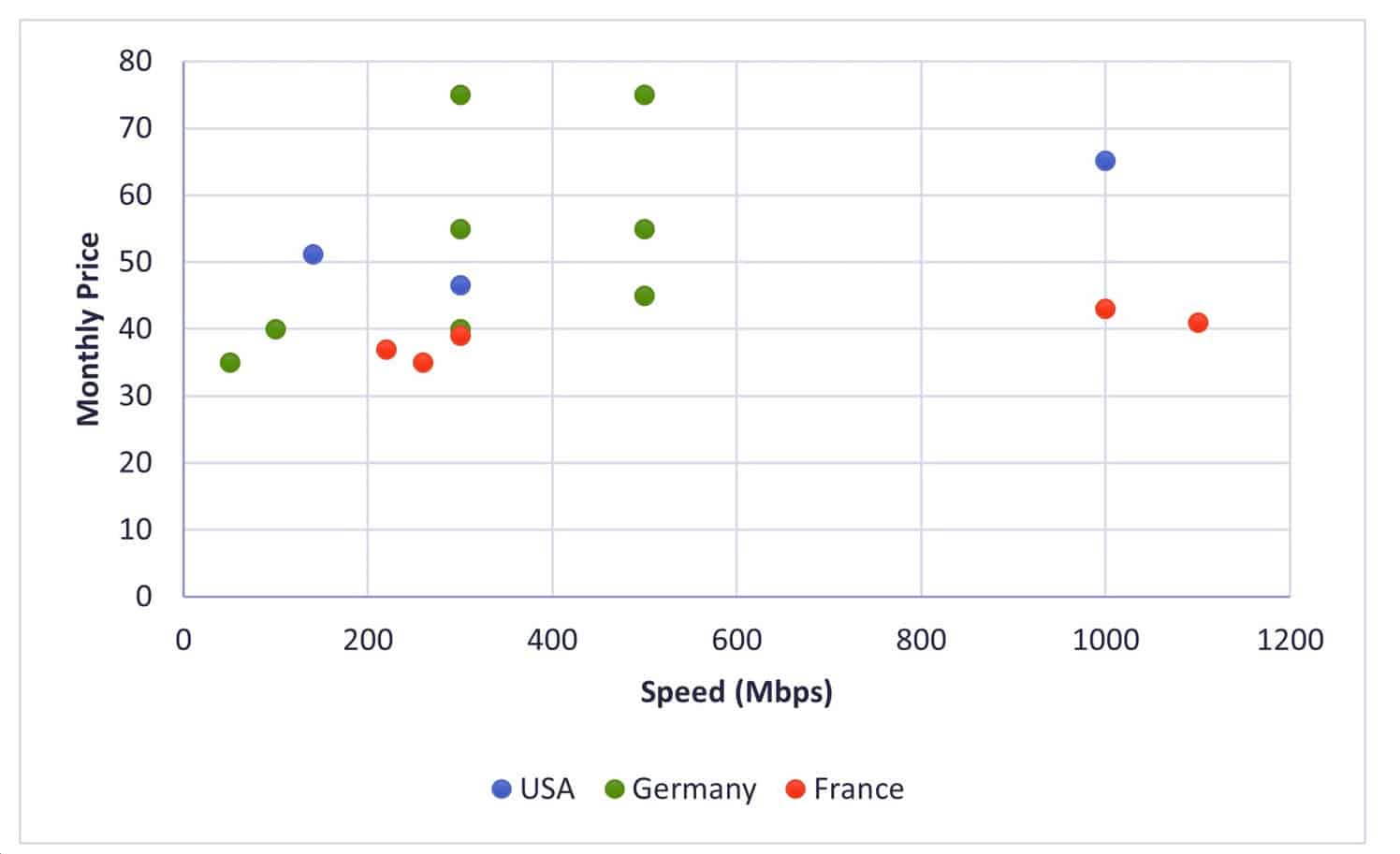

In our final chart, we have mapped ALL FWA plans covered earlier from the US, Germany, and France (so no fiber plans), to get an overview of how FWA pricing compares between the three countries.

In the United States, the emergence of 5G FWA offers promise for connecting remote areas, although fiber remains the preferred choice for its superior performance. Germany’s diverse FWA landscape caters to a range of speed and data requirements, providing versatility for users in both urban and rural areas. In France, fiber reigns supreme, emphasizing the market’s preference for high-speed, bundled solutions.

As technology continues to advance and infrastructure expands, FWA and fiber will continue to coexist, with customer preference hinging on factors such as speed requirements, coverage area, and budget constraints. The shift towards more accessible and cost-effective connectivity solutions underscores the importance of innovation and competition in the telecommunications landscape, driving towards a more inclusive and connected society.

It’s important to remember that FWA fills a crucial gap in connectivity, providing a lifeline for communities where fiber infrastructure is unavailable. Moreover, the affordability of FWA plans can offer relief for these residents accustomed to higher prices due to limited choices. However, our analysis suggests that, when both options are available, fiber’s superior speed and reliability provides a greater value for the money, making it the preferred choice.

About the Author:

Soichi Nakajima

VP Data and Analysis

snakajima@tarifica.com

With over 20 years of telecommunication market analysis experience, Soichi oversees the data collection, quality, research, analysis, and production of all data projects and quantitative studies.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com