Decoding the Discount Dance: Operators Overwhelmingly Rely on Discounts to Push Converged Bundles

by Will Watts

In recent years, one of the key buzzwords across the telecommunications industry has been “convergence” – the drive to combine an ever-expanding suite of communications and entertainment service into a single bill. Of available service types, the most sought-after pairing has been focused on the two services which are often viewed as essential for most consumers: mobile and fixed broadband.

With marketing this fixed-mobile bundle having now been at the center of operators’ corporate strategy for the last several years, this month’s TDD will review the state of play in this space, and aim to answer the following questions:

- How have operators been structuring these bundled offerings?

- What level of discounting is typically applied?

- Have operators leveraged the expanded service portfolio to launch new plan innovations?

- How do these offers vary across different countries and markets?

Background on the Convergence Trend

The logic of the move towards mobile-fixed broadband convergence is simple. In an environment where essentially all customers already have at least one mobile line and most plans are heading towards unlimited data. With increasingly limited room for innovation or differentiation, the main avenue for competition is via pricing. As operators face this constant pressure to lower prices, the best way for them to grow is by expanding into new territories—adding more services to each customer’s account. If done successfully, this approach can increase Average Revenue Per User (ARPU), even as the price for each of the individual services decreases.

Major Findings

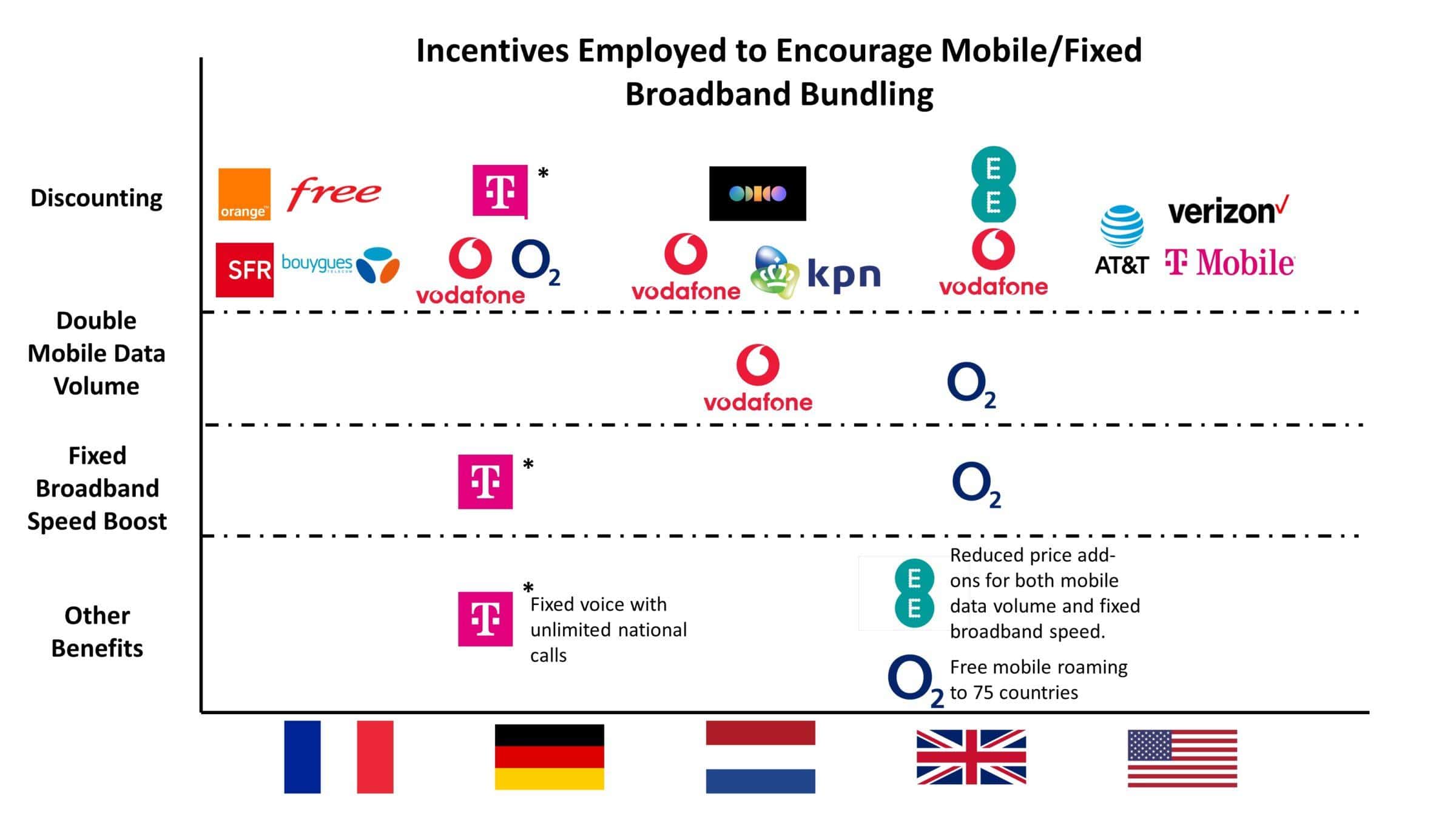

Aside from direct price reductions, operators incorporated additional strategies such as doubling mobile data volume (Vodafone Netherlands and O2 UK) and escalating fixed broadband speeds (Deutche Telekom and O2 UK). Notably, these incentives were integrated into existing offers rather than being structured as separate mobile-fixed broadband bundles.

Chart created using data from Tarifica's Telecom Pricing Intelligence Platform

Discounting, however, was far and away the most popular employed by operators. More than 88 percent of operators tracked (all but two – Three and O2, both in the UK) offered some discount for their converged packages. This generally took the form of either a blanket discount applied to the entire bill or one specific to the fixed line package.

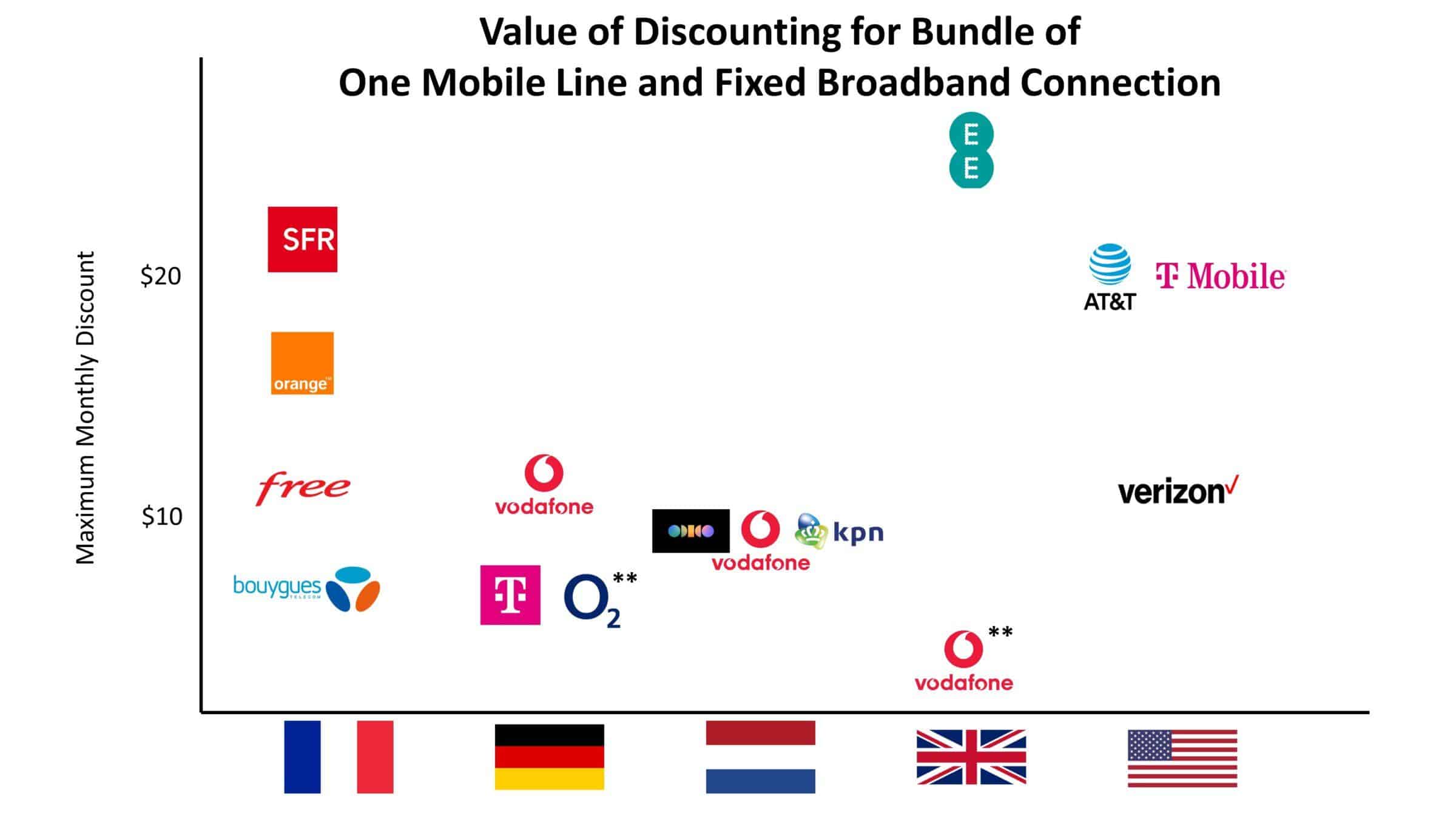

The range of discounts exhibited a diverse landscape, spanning from US $3.82 (Vodafone UK) to US $25.46 (EE in the UK). A majority of operators (53%) clustered around overall discounts between US $5.49 and US $10.98, a trend particularly evident in Germany and the Netherlands where all operators fell within this bracket.

The United Kingdom – A Battle of Diverging Strategies

The United Kingdom stood out as a remarkably diverse market in terms of approaches to converged bundling, with each of the four major providers employing a different strategy.

EE led the pack by offering a monthly discount of up to GBP 20.00 (US $25.46) for converged plans, the most substantial price reduction observed across markets in this study.

While Vodafone UK’s base discount was only GBP 3.00 (US $3.82), the operator was actually more aggressive than this number indicates, since it also offered a percentage-based reduction on the price of its mobile plan when paired with a fixed broadband offering. When the highest-priced mobile plans were selected, the operator’s discount was almost comparable to that of EE.

Although it was one of only two operators in this study which did not offer any discount, O2 was still active in the converged space with a three-part series of other incentives: doubling mobile data, increased fixed broadband speeds, and adding free international roaming to 75 countries to mobile plans.

Finally, standing in distinct contrast to the other major UK providers was Three, which did not offer any kind of incentive for subscribing to converged offers. Indeed, Three stood apart from all the providers examined in this study. This choice appeared to be an asymmetric strategy–in a market crowded with bundling offers and discounts, Three instead directed attention to its standard low prices, which are available to all customers.

The Netherlands, United States and Germany – General Alignment Between Competitors

In contrast to the diverse strategies observed in the United Kingdom, operators in the United States and the Netherlands exhibit a high degree of alignment with their respective in-market rivals.

In the Netherlands, all three major players presented a unified discounting structure, reaching a maximum of EUR 7.50 (US $8.23) based on the packages selected. The only distinguishable factor among these providers is that Vodafone also included double mobile data in its converged bundle.

Turning to the United States, both AT&T and T-Mobile mirrored each other by offering identical discounts of US $20.00/month. While this might appear substantially different from Verizon Wireless, whose discounts start at US $10.00/month, Verizon’s discount scales with the number of mobile lines included on the account (up to four lines). Consequently, for some consumers, Verizon’s discounts can end up exceeding that offered by its competitors. None of these providers extend any other substantial benefits to this category of bundled customers.

Finally, in Germany, each operator maintained its distinct approach while still generally falling within the same range of total discount values. Vodafone offered a maximum reduction of EUR 10.00 (US $10.98) on the monthly fee. While O2 only provided half of this amount at EUR 5.00 (US $5.49) as a base discount, it also introduced a scaling percentage-based discount on the mobile line. For most plans, the cumulative value of these discounts was quite comparable to Vodafone’s reduction. Finally, Deutsche Telekom introduced a meaningful strategic differentiation in the market by offering consumers the choice of a EUR 5.00 (US $5.49) discount, double mobile data, or a fixed landline with unlimited national calling. However, the limitation of allowing customers to only select one option positions Deutsche Telekom as the least aggressive German operator in this space.

France – Discounts of Different Scales

Turning to France, all four major MNOs in France adopted a unified strategy to push consumers toward their converged plans through escalating discounts. While this basic structure is the same across all operators, France is separated from the Netherlands, US, and Germany because there is a meaningful range in discount value across the different providers in the market.

At the lower end of the spectrum, Bouygues offered a modest EUR 5.00 (US $5.49) price reduction. Moving up, Free presented a more substantial discount of EUR 10.00 (US $10.98), providing an intermediary option for consumers. Orange goes further by offering a EUR 15.00 (US $16.47) discount. Leading the pack, however, was SFR with a price reduction of EUR 20.00 (US $21.96), securing its status as the market leader in discounted bundled offerings.

It’s worth noting that none of these operators introduced any other significant incentives for this type of bundling, underlining the primary focus on escalating discounts as the key driver in the French market’s convergence landscape.

Conclusion

The wave of consolidation in pursuit of convergent offers appears to have crested. At this point, most MNOs in advanced markets have secured the ability to offer fixed broadband services, making them a standard part of their offerings.

This may not be good news for Telcos, however, as this study identifies a potentially troublesome trend. When nearly all operators can offer converged bundles and rely primarily on discounts for marketing, they risk recreating the environment of service commoditization, which leads to increased downward pricing pressure. These conditions echo the dynamics observed in the mobile space, albeit on a larger scale.

In their strategic discussions and new plan development, operators are advised to follow the models advanced by O2 in the UK and Deutsche Telekom in Germany. They should focus on crafting offers which differentiate themselves not only through price, but also via unique services and features.

About the Author:

Will Watts

VP of Product

wwatts@tarifica.com

Will is responsible for the planning, build-out, and maintenance of Tarifica’s data solutions, including the flagship Digital Intelligence Platforms. In his more than 10 years at Tarifica, he has successfully delivered custom projects and market analyses to clients such as GSMA, the World Bank, BEREC, Verizon and Telefonica.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com