Unlocking the Impact: iPhone 15 Launch Spurs Competition in US Mobile Market

by Will Watts

Since last month’s launch of the iPhone 15, US carriers have been scrambling to launch promotions for this new device and win their share of the increased interest from those who are eager to purchase the latest model. The maturity of the US mobile market, with near universal mobile ownership, combined with the substantial dominance of Apple, with over 55% of US smartphone users on iOS, create an environment in which iPhone releases trigger a significant wave of customer churn. The increase in turnover also has a remarkable impact on the acquisition of new mobile customers, making Apple device launches pivotal events in the US mobile market.

While extended device lifespans and incremental tech upgrades have somewhat tempered the excitement surrounding iPhone launches in recent years, these moments continue to hold a central position in the strategic planning of many operators, particularly in the US. Faced with this competitive opportunity, American operators have rolled out aggressive new promotions tied to the iPhone, aiming to secure long-term commitments from consumers.

This edition of TDD will review the promotional strategies currently employed, the expected lifecycles of these offers, and the impact of using this type of device-centric sales model for mobile carriers.

Current Lead Deals for the iPhone 15

While the specific terms vary somewhat, all three carriers have introduced similar promotions which offer customers up to $1,000 off the iPhone 15 when they trade in qualifying devices.

The primary difference between these promotions is the financing term length. With T-Mobile, the device would be paid off within 24 months. On the other hand, Verizon Wireless and AT&T use their deals to lock in customers for 36 months. All offers require that the users subscribe to one of the carrier’s highest-tier plans and maintain this connection for the length of the financing in order to keep the savings. These financing discounts are applied as follows: a T-Mobile customer purchasing the iPhone 15 for $1199 would technically ow $49.96/month ($1199/24) but $41.67 ($1000/24) of this would be credited from this promotion – meaning the customer’s bill would only increase by $8.29/month. That said, if the customer were to leave T-Mobile early, they would then be responsible for the full $49.96 for the rest of the financing term.

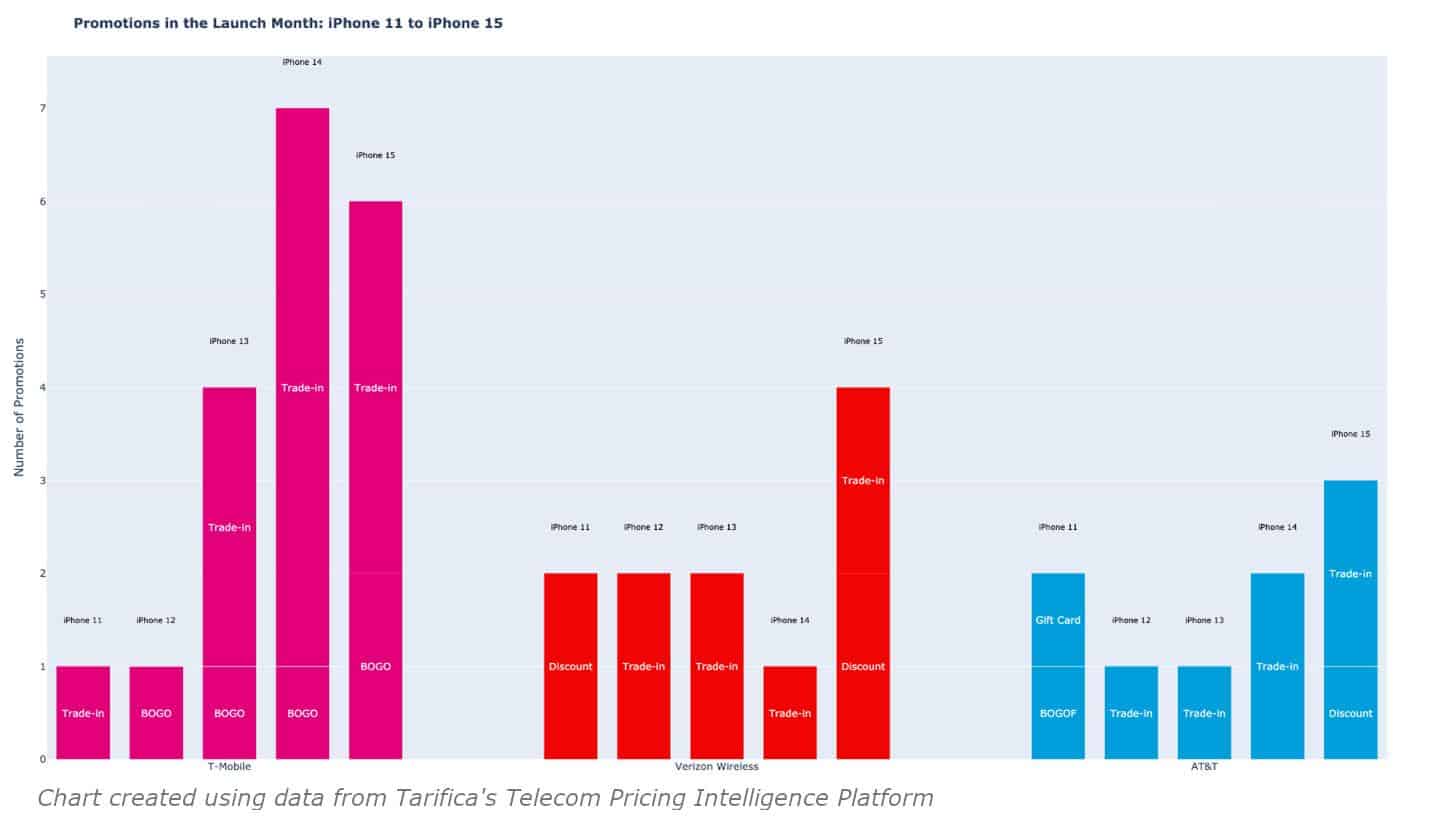

Evolution of iPhone Launch Strategies – The Rise of Trade-Ins

iPhone launches have long been the marquee event for mobile operators. When we analyze the chart below, which examines the five most recent iPhone launches, a few notable trends emerge.

Chart created using data from Tarifica's Telecom Pricing Intelligence Platform

Firstly, trade-in promotions have increasingly become the central iPhone sales strategy. Although they held a meaningful place in the high-end device promotional landscape back in 2019, they have since evolved to virtually dominate the market. This shift is primarily attributed to the increasing lifecycle of smartphones, since operators can recoup some of the discounts offered by rehabbing and then reselling the traded-in devices, typically to consumers in emerging markets.

Simultaneously, the prevalence of buy-one-get-one (BOGO) deals and other types of promotions, such as those involving gift cards, has significantly declined. One possible explanation is that the increased lifespan of smartphones has rendered BOGO offers less enticing for consumers, who might be unable to synchronize the upgrades of multiple devices. Meanwhile, gift cards lack the advantage of locking consumers into device financing plans, even if the total discount offered on a gift card is lower in terms of overall cost. Consequently, it’s not surprising that mobile operators have largely migrated away from such promotions.

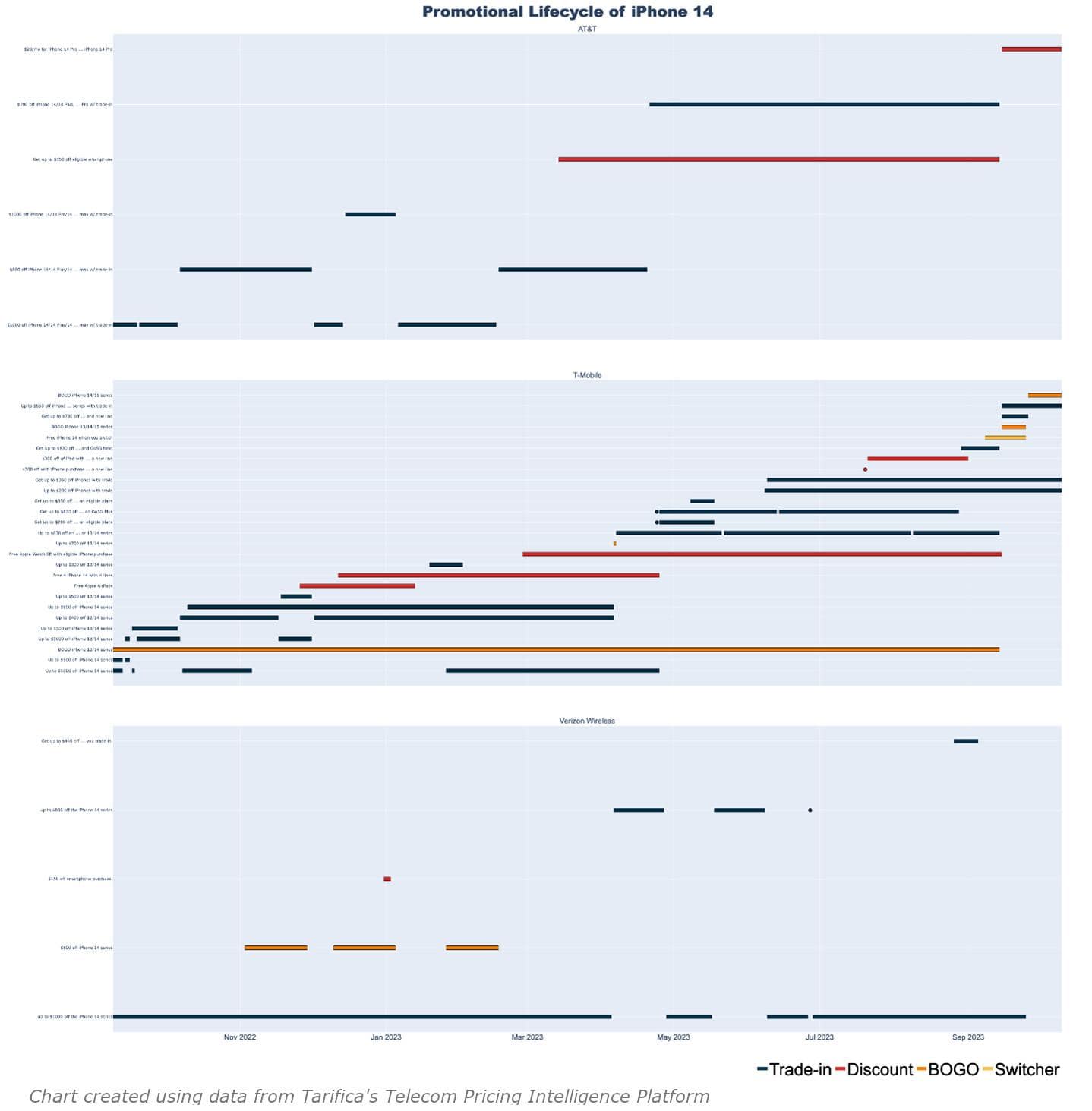

Promotional Lifecycle of a Flagship Device – Varied Promotional Strategies for Major Providers

With the now annual release of new iPhone models, a regular pattern of promotions has developed over the course of the device’s lifecycle. When a new iPhone is announced, mobile providers generally kickstart the cycle by unveiling a range of deals which are designed to win over the early adopters and can be featured in their marketing campaigns. As the year progresses, new deals filter in and out, based on each operator’s sales priorities and seasonal trends. Toward the end of the year, as anticipation builds for the announcement of next year’s models, further discounts to the current models are unveiled to entice budget-conscious customers and clear out old inventory.

For instance, in September, Verizon Wireless not only introduced deals for the iPhone 15, it also made the iPhone 14 available for $0 per month without requiring a trade in for new subscribers to qualifying Verizon plans. This deal highlights how aggressive providers can be, even with only slightly older iPhone models.

The chart below explores how these competitive dynamics change over the year the iPhone 14 reigned as the top phone in the US market. It displays all available promotions for the iPhone 14 from the three Tier One US mobile providers from its launch in September 2022 until it was succeeded by the iPhone 15 a year later.

We can see that, during the iPhone 14’s model year, T-Mobile consistently led in the number of promotions offered, with several deals running concurrently at any given time. These promotions changed frequently, with dense clusters observed around the Christmas holiday season and the start of summer. While most of T-Mobile’s promotions followed the standard trade-in format, providing discounts ranging from $500 to $1000 over a 24-month period, the carrier also diversified its offers. This included occasional BOGO deals and promotions featuring incentives such as free AirPods or Apple Watches.

In contrast, AT&T opted for a more streamlined approach, typically running only one promotion at a time and never exceeding two concurrent deals. Despite their lower quantities, AT&T’s promotions tended to run for longer, averaging more than 60 days for each promotion.

While not as active as T-Mobile, Verizon Wireless contrasted with AT&T by typically offering two iPhone 14 promotions at once. Moreover, the provider employed a start-and-stop strategy with certain promotions throughout the year. For instance, their $800 discount offer on the iPhone 14 was “discontinued” twice, only to be reinstituted a few weeks later each time. Although almost all of Verizon Wireless’ deals required financing, they briefly deviated from this strategy around the New Year by offering a $150 discount with no trade-in or financing requirements. Because this offer was short-lived (available for less than a week), its appearance suggests a hoilday-season strategy rather than a permanent shift in Verizon Wireless’ promotional approach.

Contrasting the iPhone with other Flagship Smartphones

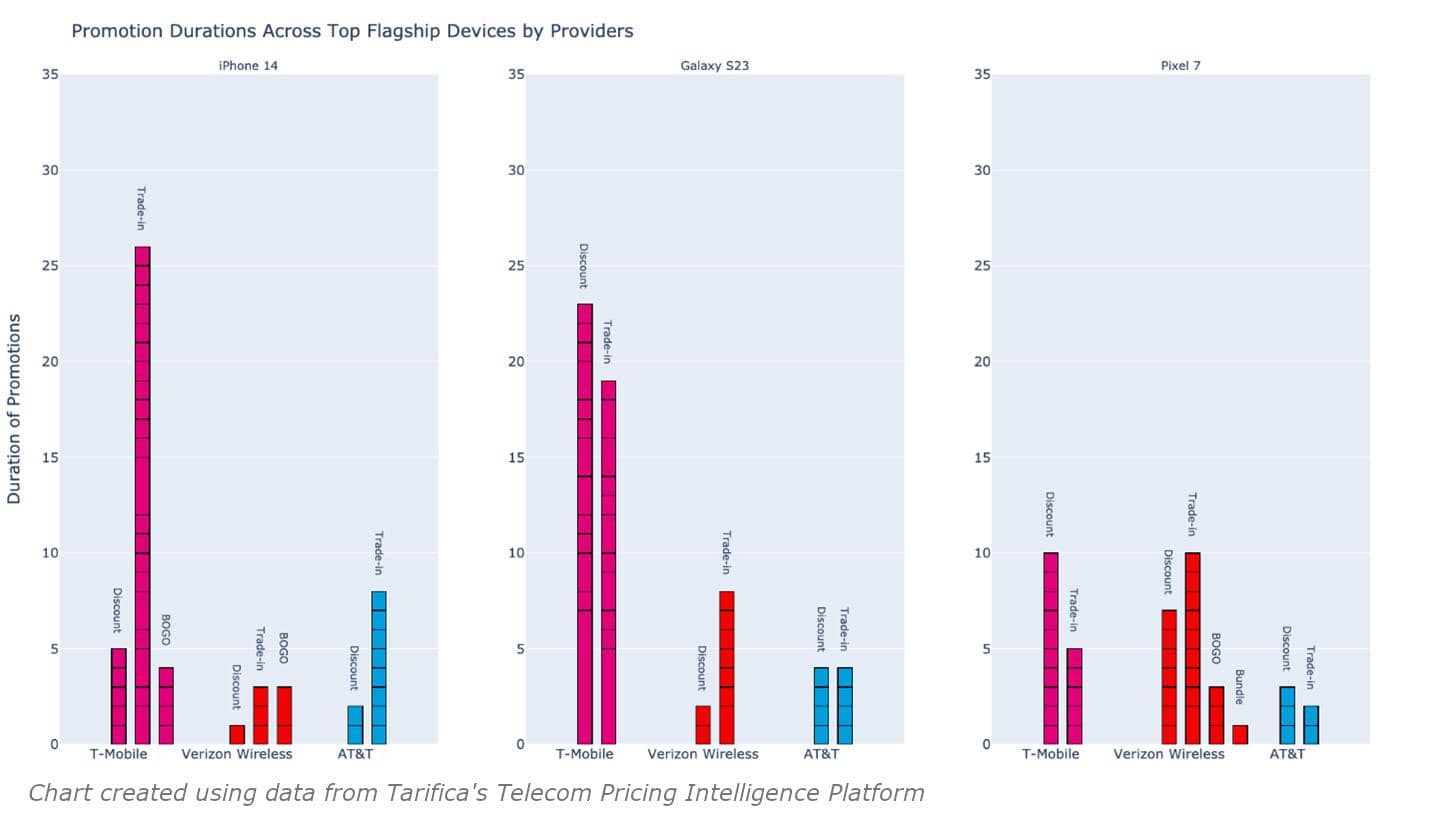

While the iPhone is unquestionably the most important phone in the US market, it’s important to recognize that it’s not the only marquee device with the potential to attract customers. Samsung’s Galaxy series and Google’s Pixel phones also enjoy popularity among certain consumer groups and boast similarly high price tags. As such, as the charts below demonstrate, mobile operators frequently target them for promotions as well.

When examining the strategies employed to promote these devices over their first year on the market in the above chart, we can see that AT&T’s approach remained fairly consisten across the iPhone 14, Pixel 7 and Galaxy S23. The carrier launched a comparable number of similar promotions for all three of these flagship devices.

Surprisingly, Verizon Wireless ran the highest number of promotions for the Pixel 7, and also exhibited the most variety in offer type for this device. While some of these mirrored trade-in offers which dominated Verizon’s promotions on the iPhone 14 and Galaxy S23, the operator also threw in several instant discounts which did not depend on financing. Additionally, the carrier occasionally offered bundles that included Google’s earbuds and/or smartwatches as part of the deal.

On the other hand, T-Mobile’s strategy diverged from Verizon’s, with a tighter focus on the iPhone 14 and Galaxy S23, and fewer promotions for the Pixel 7. Furthermore, T-Mobile predominantly offered trade-in promotions for the iPhone, while its deals for other devices more frequently featured instant discounts applied directly to the phone’s price.

Market Background

The US mobile market is primarily dominated by three major “Tier One” MNOs — Verizon Wireless, AT&T and T-Mobile. Since all three carriers have shifted to unlimited data plans, their marketing and promotional efforts now predominantly revolve around flagship smartphones. Each carrier maintains multiple promotions at once, all of which tend to undergo frequent changes.

In addition to these major players, numerous smaller MVNOs also compete in the market. Some of these are discount brands owned by one of the larger Tier Ones. However, they primarily focus on offering cost-effective plans tailored to consumers who wish to hold onto their current devices and minimize their plan expenses. While a few of these brands have had some success, none have managed to disrupt the market significantly enough to challenge the dominance of the Tier One carriers.

A notable characteristic of the US mobile landscape is the prevalence of family plans, especially among high-value consumers. These plans often include multiple smartphone lines, data-only subscriptions, and bundled IoT devices, all consolidated onto a single bill. Consequently, a relative small number of consumers can exert a disproportionate influence on the market: if they opt to switch carriers, all their associated lines migrate together.

Since the introduction of T-Mobile’s “Un-Carrier” strategy, traditional mobile service contracts have become increasingly rare in the market. Operators still need to offer steep discounts to remain competitive in the smartphone market, and they have replaced service contracts with long-term device financing plans. While it remains technically possible for consumers to switch providers while continuing to pay their original operator for the device, this happens infrequently in practice. As a result, these financing arrangements effectively lock in customer accounts when they purchase a new phone.

Conclusion

The US market’s mobile operators view the annual release of iPhones as a critical competitive opportunity. To address this, most carriers deploy aggressive promotions on these devices, particularly structuring these to secure long-term commitments from customers. In this edition of Tarifica’s Data Dive, we have delved into the intricacies of these strategies, revealing the diverse approaches taken by major US providers. As the iPhone continues to set the pace in the US mobile market, the strategies employed by major MNOs showcase how operators are adapting to the evolving needs and preferences of their customers.

About the Author:

Will Watts

VP of Product

wwatts@tarifica.com

Will is responsible for the planning, build-out, and maintenance of Tarifica’s data solutions, including the flagship Digital Intelligence Platforms. In his more than 10 years at Tarifica, he has successfully delivered custom projects and market analyses to clients such as GSMA, the World Bank, BEREC, Verizon and Telefonica.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com