Beyond Numbers: The Tale of 5G Pricing and Data Evolution

by Soichi Nakajima

Since its launch in 2019, 5G connectivity has swept across the globe. As we mark its fourth year, let’s take a closer look at how the mainstreaming of 5G has altered the telecommunications landscape:

- The proliferation of 5G plans compared with non-5G plans (e.g., 4G, LTE and their various iterations)

- The pricing of 5G plans compared with non-5G plans

- The evolution of 5G plans over time

In this first edition of Tarifica’s Data Dive, we will tackle these points using proprietary plan and pricing data collected for 16 countries from our flagship Telecom Pricing Intelligence Platform (“TPIP”).

5G Plans vs Non-5G Plans: Quantity

In this first section, we explore the distribution of 5G and non-5G plans across 16 select countries.

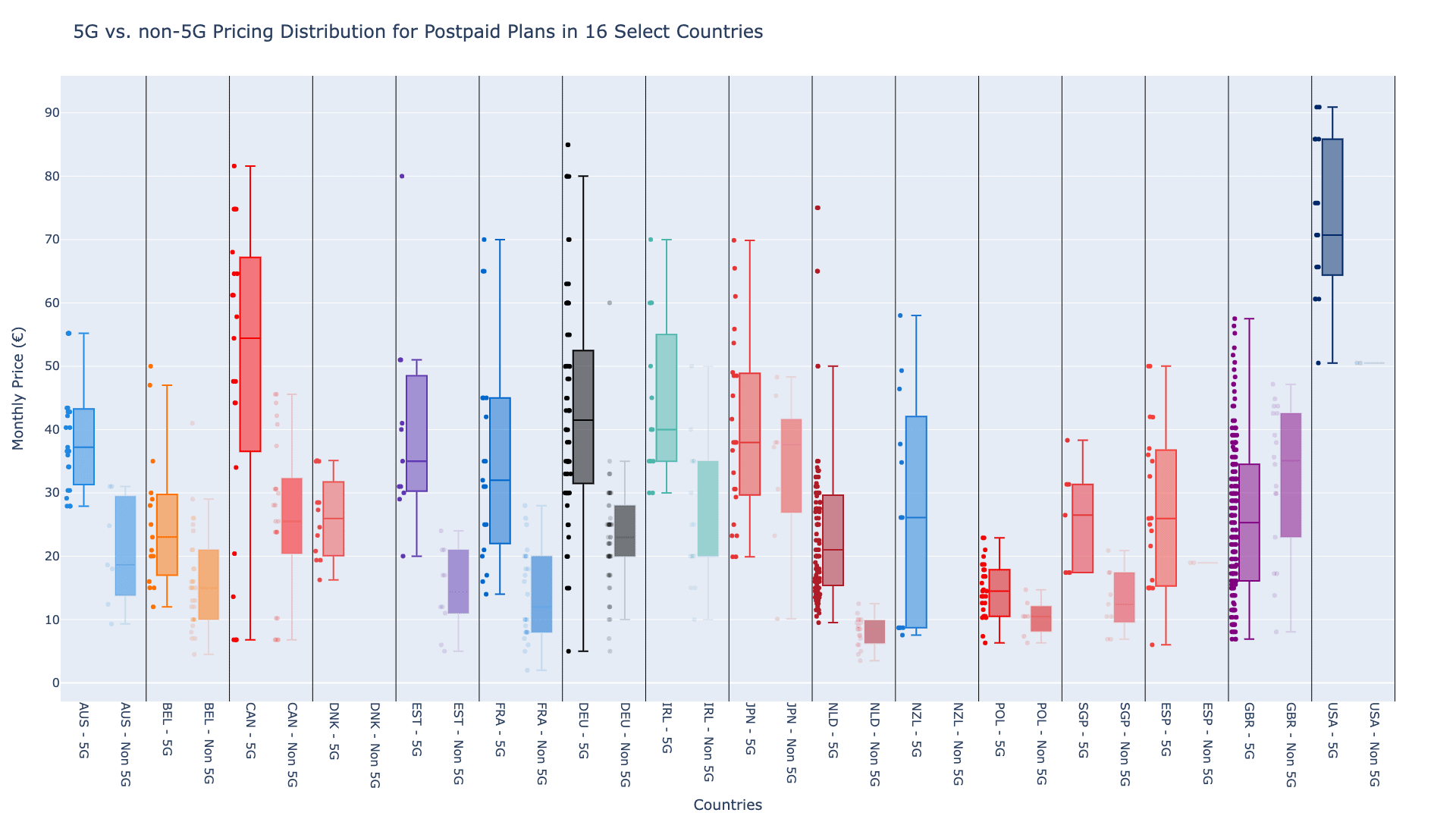

The box plot to the left shows the distribution of all mobile postpaid 5G and non-5G plans (i.e., LTE, 4G, 4G+, etc.) across these countries, with all other criteria constant.

The data in this chart illustrate a significant trend: 5G plans are increasingly outnumbering their non-5G counterparts in many markets. Notably, countries like Denmark and New Zealand have fully embraced 5G, with all plans covered being 5G-compatible, and therefore non-5G plans are absent on the chart for these countries.

Furthermore, we can see that 5G plans tend to come at a premium, with average prices exceeding those of non-5G plans. In fact, the highest price for non-5G plans comes in at only two-thirds that of the highest 5G plans. This finding should not be surprising. Given the high-end nature of 5G services, they are commonly bundled with generous data allowances.

5G Plans vs Non-5G Plans: Price and Data

In pursuit of unparalleled connectivity and faster speeds, 5G technology has emerged as a herald of innovation. This evolution, however, comes with a price–both literal and metaphorical.

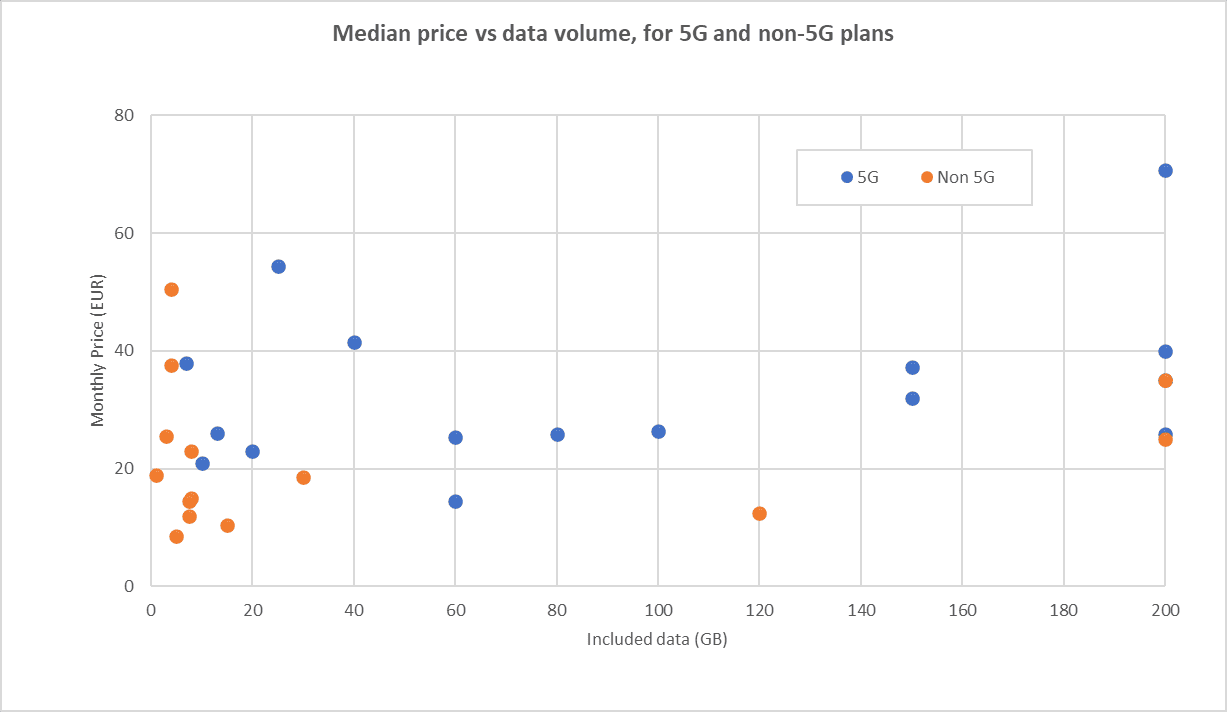

The chart below illustrating the median prices and data allowances of 5G and non-5G plans paints a clear picture of this dichotomy.

Assessing the same countries as above, this chart plots both the median price and the median data allowance for 5G and non-5G plans for these countries. For our purposes, all plans with unlimited data have been plotted as having 200GB of data.

The blue dots on the chart embody the essence of 5G’s premium positioning. These dots represent 5G plans, which, as the chart shows, consistently command higher median prices compared to their non-5G counterparts. This phenomenon arises from the substantial investments required for 5G infrastructure, coupled with the promise of cutting-edge speeds and seamless connectivity. The blue dots’ upward trend signifies that consumers are embracing the allure of 5G, even as it comes at a premium cost.

In addition, as technology advances, data has become the modern-day currency of communication. A closer inspection of the chart reveals that 5G plans are not just more expensive; they also offer more data volume compared to non-5G plans. For example, the blue dot at the top-right corner of the chart indicates that for a certain country (in this case, the US), for the 5G plans, the median price is €70 with a median data amount of 200GB (unlimited). This tells us that the US 5G plans tend to be more expensive compared to other countries, but also that the majority of them include unlimited data. On the other end of the scale, at the bottom-left, is the orange dot from the Netherlands, where its non-5G plans have a median price of €8.50 and include just 5GB of data.

Taking the average of the values in this chart, our data shows that compared to non-5G plans, 5G plans are roughly 1.5 times more expensive, while including slightly more than double the amount of data. This duality of increased data and heightened cost is a strategic move by service providers to cater to the data-hungry demands of today’s digital lifestyles. The proliferation of data-centric applications, from video streaming to cloud computing, has driven the push for larger data allowances.

The pronounced difference between 5G and non-5G plans underscores a pivotal shift in the telecommunications landscape: though 5G plans were initially introduced as a luxury, high-end service with lofty amounts of data, as we increasingly rely on digital connectivity for work, leisure and communication, the demand for enhanced data and speed capabilities grows in tandem. The continued mainstreaming of 5G plans foretells a future where data is the lifeline of modern living.

Evolution of 5G and Non-5G Plans Over Time

This final section takes us on a journey through time as we explore the evolution of pricing and data allowances for 5G and non-5G plans.

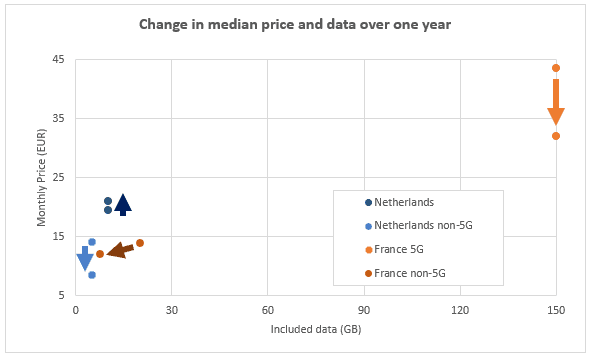

Our data shows this development differs depending on the country. As an example of these differences, the chart below focuses on the evolution of such plans in France and the Netherlands from Q2 2022 to Q2 2023.

By comparing France and the Netherlands, we uncover some intriguing trends. In France, it seems that 5G plan prices have actually gone down over time, while the amount of included data has stayed the same. This suggests a shift towards increased accessibility of 5G, a change which aligns with the introduction of 5G in mid-range plans and the gradual phasing out of non-5G options.

Shifting focus to the Dutch market reveals that while the amount of data included in 5G plans hasn’t changed, the median price has gone up slightly. It appears there is a growing preference for premium pricing, although it’s worth noting that 5G is still more affordable in the Netherlands than in France. On the flip side, non-5G plans in the Netherlands have actually become more affordable while still offering the same amount of data, indicative of a pricing divide between 5G and non-5G plans.

Intricacies Beyond Numbers

Our data-driven journey reminds us that the telecom landscape is a nuanced realm, influenced by an array of factors beyond raw numbers. At Tarifica, we capture these subtleties to provide you with a holistic view of the industry. The intersection of data and cost signifies the delicate balance that telecom providers must navigate to meet user expectations, while still maintaining their own economic viability.

Conclusion

As we wrap up this inaugural edition of Tarifica’s Data Dive, we hope you’ve found value from our glimpse into the complex world of telecom pricing and plans. Our data-driven insights illuminate trends and transformations, but the full picture requires a deeper exploration of the industry’s intricacies. We invite you to stay tuned as we continue to unravel the ever-evolving tapestry of telecommunications.

About the Author:

Soichi Nakajima

VP Data and Analysis

snakajima@tarifica.com

With over 20 years of telecommunication market analysis experience, Soichi oversees the data collection, quality, research, analysis, and production of all data projects and quantitative studies.

For questions or comments about this analysis, please contact Penny Wiesman at pwiesman@tarifica.com